# BVNK API Documentation

> Complete API documentation for BVNK payment infrastructure - crypto payments, wallets, and financial services

This file contains all documentation content in a single document following the llmstxt.org standard.

## 2025-08-30

Technical changes and notices.

- API response fields: additive fields may be introduced without prior notice. Ensure deserializers ignore unknown keys to avoid runtime errors.

- Deprecation: `transactions[].risk` data remains unavailable; clients should not rely on this field.

- Channels redirect: migration of `redirectUrl` from `business.coindirect.com` to `pay.bvnk.com` is complete; ensure any allowlists are updated.

- CSV export: wallet transaction CSV exports now support both preset ranges and custom date ranges via the portal.

Reference: `https://docs.bvnk.com/changelog#/`

---

## 2025-09-12

Highlights from the BVNK change log.

- Channels `redirectUrl` migrating from `business.coindirect.com` to `pay.bvnk.com` (Nov 2023)

- JSON deserialization notice: clients should tolerate additive fields

- `transactions[].risk` data deprecated from 2023-10-01

- Export wallet transactions to CSV by period or date range

- Improved payment status labels: Late, Underpaid, Overpaid

Source: `https://docs.bvnk.com/changelog#/`

---

## Release notes

This section contains release notes and change history for the BVNK API and portal.

---

## BVNK Main API

Welcome to the BVNK Main API documentation. This API enables seamless and secure transactions, including payments, channels, and digital wallet operations.

## Getting Started

Before you begin, make sure you have:

- Created an account on the [BVNK Merchant Portal](https://app.sandbox.bvnk.com)

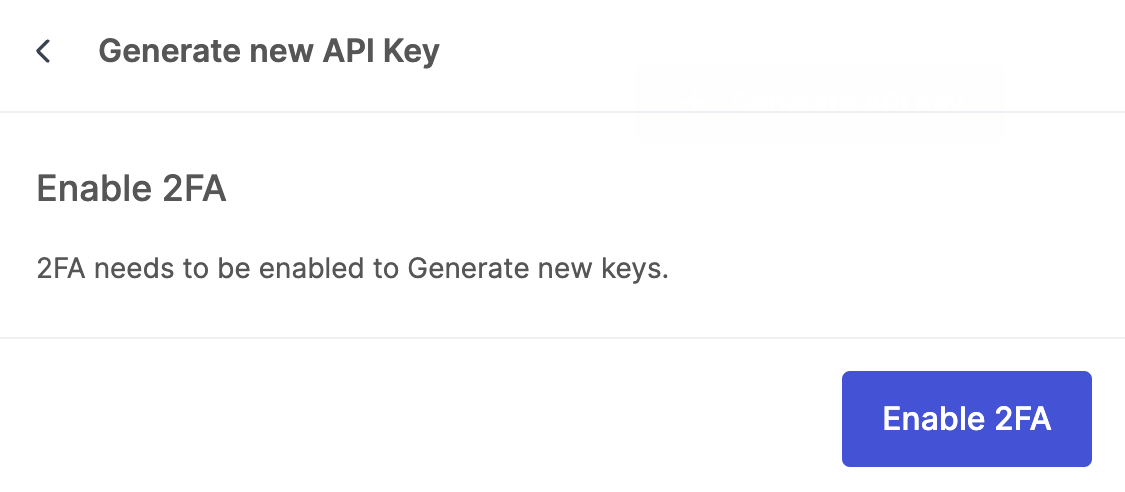

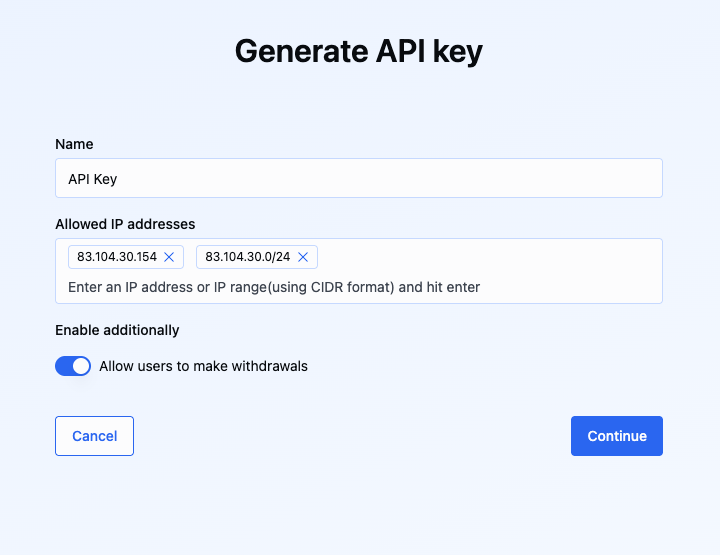

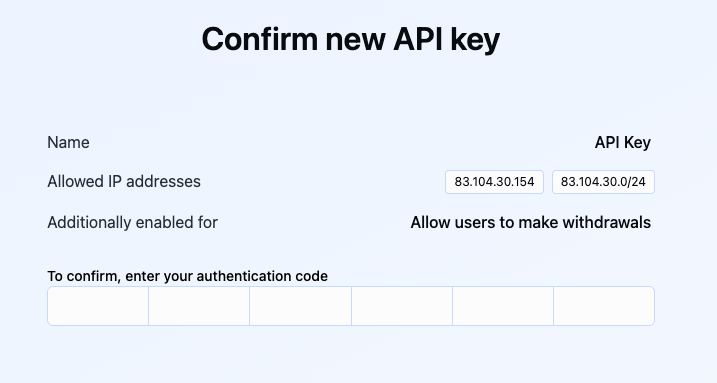

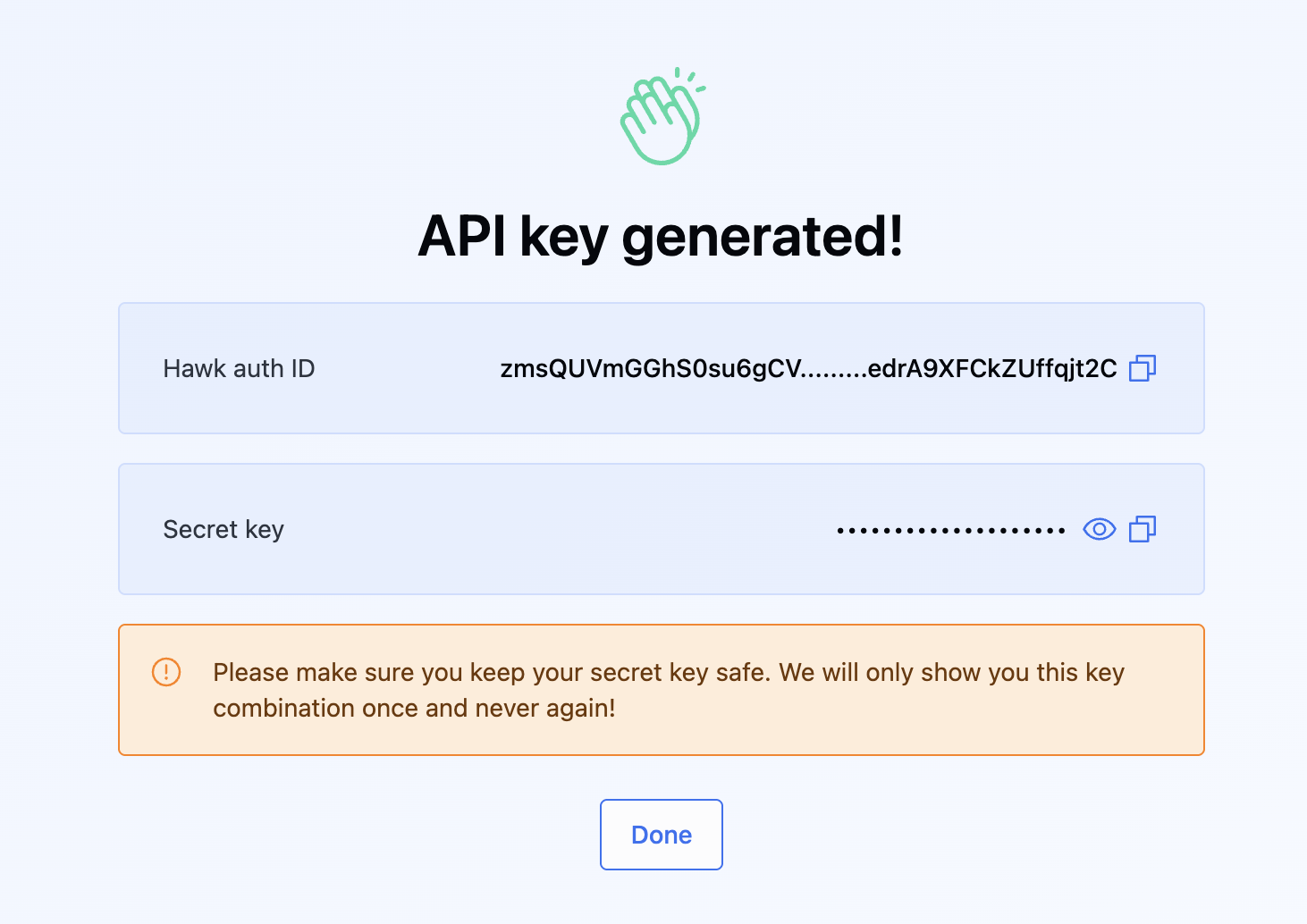

- Generated your API keys (Hawk Auth ID and Secret Key)

- Reviewed the authentication requirements

## API Environments

- **Production**: `https://api.bvnk.com`

- **Sandbox**: `https://api.sandbox.bvnk.com`

## Overview Articles

- [Overview](/bvnk/api-explorer/api-overview/overview)

- [Authentication](/bvnk/api-explorer/api-overview/authentication)

- [Errors](/bvnk/api-explorer/api-overview/errors)

- [Idempotency](/bvnk/api-explorer/api-overview/idempotency)

- [Metadata](/bvnk/api-explorer/api-overview/metadata)

- [Pagination](/bvnk/api-explorer/api-overview/pagination)

## API Endpoints

For detailed API endpoint documentation, see the [API Reference](/api/bvnk-main-api).

---

## Authentication

Most interactions with the BVNK Crypto Payments API require the use of the API keys.

Before moving forward, make sure you have already created your `Hawk Auth ID` and `Hawk Auth Key` as described in [Generate API Keys](../../../get-started/generate-api-keys), as you won't be able to progress without them.

## HAWK Authentication

BVNK employs Hawk Authentication to ensure the authenticity of requests made to our APIs. The [Hash-based Message Authentication Code (HMAC)](https://www.okta.com/identity-101/hmac/) is calculated using SHA256.

While HAWK supports optional payload validation for POST and PUT data, along with response payload validation, these features are not activated for the BVNK API and can be disregarded.

Below, you will find code examples for the most commonly used programming languages.

:::warning

These snippets are ready to use but to reflect your specific requirements, adjust the following:

* `method`

* `url`

* `Hawk Auth ID`

* `Hawk Auth Key`

:::

```java

/**

* Main class demonstrates the generation of a Hawk authentication header.

*/

public class Main {

// The credentials used to generate the Auth headers

static String id = "<>";

static String key = "<>";

static String algorithm = "HmacSHA256"; // The hashing algorithm used.

// The request to be performed

static String method = "GET";

static String url = "https://api.sandbox.bvnk.com/api/v1/merchant";

public static void main(String[] args) throws Exception {

String header = hawkHeader(url, method, id, key, algorithm);

System.out.println(header);

}

/**

* This method generates a timestamp of the current time in seconds

*

* @return A timestamp in seconds

*/

public static long getTimestampInSeconds() {

return System.currentTimeMillis() / 1000;

}

/**

* This method creates a string of random alphanumeric characters

*

* @param length The required length of the string

* @return A string of random characters

*/

public static String generateNonce(int length) {

String possible = "ABCDEFGHIJKLMNOPQRSTUVWXYZabcdefghijklmnopqrstuvwxyz0123456789";

StringBuilder text = new StringBuilder(length);

Random rnd = new SecureRandom();

for (int i = 0; i < length; i++) {

text.append(possible.charAt(rnd.nextInt(possible.length())));

}

return text.toString();

}

/**

* This method generates a normalized string out of the header options

*

* @param type The request type

* @param ts The timestamp in seconds

* @param nonce The generated nonce

* @param method The HTTP method of the call

* @param url The URL of the request

* @param host The host

* @param port The port

* @param hash The hash

* @return A normalized string containing all parts to be hashed

*/

public static String generateNormalizedString(String type, long ts, String nonce, String method, String url, String host, String port, String hash) {

String headerVersion = "1";

return "hawk." + headerVersion + "." +

type + "\n" +

ts + "\n" +

nonce + "\n" +

method.toUpperCase() + "\n" +

url + "\n" +

host.toLowerCase() + "\n" +

port + "\n" +

hash + "\n" +

"\n";

}

/**

* This method generates the request Message Authentication Code (MAC) using the MAC-SHA256 hashing algorithm

*

* @param type The type to generate

* @param key The key used to generate the Auth header

* @param options The options used to generate the code

* @return a request MAC

*/

public static String generateRequestMac(String type, String key, String options) {

byte[] hmacSha256 = HmacUtils.hmacSha256(key, options);

return Base64.getEncoder().encodeToString(hmacSha256);

}

/**

* This method generates the Hawk authentication header

*

* @param uri A full URI string

* @param method The HTTP method (GET, POST, etc.)

* @param id The ID from the credentials

* @param key The key from the credentials

* @param algorithm The algorithm from the credentials

* @throws URISyntaxException Will throw an error if the provided URI string is of an invalid type.

* @return The Hawk authorization header

*/

public static String hawkHeader(String uri, String method, String id, String key, String algorithm) throws URISyntaxException {

// Application time

long timestamp = getTimestampInSeconds();

// Generate the nonce

String nonce = generateNonce(6);

// Parse URI

URI parsedUri = new URIBuilder(uri).build();

String host = parsedUri.getHost();

String port = String.valueOf(parsedUri.getPort() == -1 ? (parsedUri.getScheme().equals("http") ? 80 : 443) : parsedUri.getPort());

String resource = parsedUri.getPath() + (parsedUri.getQuery() != null ? "?" + parsedUri.getQuery() : "");

// Prepare artifacts object to be used in MAC generation

String options = generateNormalizedString("header", timestamp, nonce, method, resource, host, port, "");

// Generate the MAC

String mac = generateRequestMac("header", key, options);

// Construct Authorization header

return "Hawk id=\"" + id + "\", ts=\"" + timestamp + "\", nonce=\"" + nonce + "\", mac=\"" + mac + "\"";

}

}

```

```csharp

using System;

using System.Security.Cryptography;

using System.Text;

using System.Linq;

public class MainClass

{

// The credentials used to generate the Auth headers

private static string id = "<>";

private static string key = "<>";

private static string algorithm = "HMACSHA256";

// The request to be performed

private static string method = "GET";

private static string url = "https://api.sandbox.bvnk.com/api/v1/merchant";

public static void Main(string[] args)

{

try

{

string header = HawkHeader(url, method, id, key, algorithm);

Console.WriteLine(header);

}

catch (Exception e)

{

Console.Error.WriteLine("Error occurred:");

Console.Error.WriteLine(e);

}

}

///

/// Generates a timestamp of the current time in seconds.

///

/// A timestamp in seconds.

public static long GetTimestampInSeconds()

{

DateTimeOffset dto = DateTimeOffset.Now;

return dto.ToUnixTimeSeconds();

}

///

/// Creates a string of random alphanumeric characters.

///

/// The required length of the string.

/// A string of random characters.

public static string GenerateNonce(int length)

{

const string chars = "ABCDEFGHIJKLMNOPQRSTUVWXYZabcdefghijklmnopqrstuvwxyz0123456789";

var random = new Random();

return new string(Enumerable.Repeat(chars, length).Select(s => s[random.Next(s.Length)]).ToArray());

}

///

/// Generates a normalized string out of the header options.

///

/// A normalized string containing all parts to be hashed.

public static string GenerateNormalizedString(string type, long ts, string nonce, string method, string url, string host, string port, string hash)

{

string headerVersion = "1";

return $"hawk.{headerVersion}.{type}\n{ts}\n{nonce}\n{method.ToUpper()}\n{url}\n{host.ToLower()}\n{port}\n{hash}\n\n";

}

///

/// Generates the request Message Authentication Code (MAC).

///

/// A request MAC generated from the HMAC-SHA256 hashing algorithm.

public static string GenerateRequestMac(string type, string key, string options)

{

using var hmac = new HMACSHA256(Encoding.UTF8.GetBytes(key));

byte[] hashBytes = hmac.ComputeHash(Encoding.UTF8.GetBytes(options));

return Convert.ToBase64String(hashBytes);

}

///

/// Generates the hawk authorization header.

///

/// A Hawk authorization header including the Hawk Auth ID, timestamp, nonce, and MAC.

public static string HawkHeader(string uriStr, string method, string id, string key, string algorithm)

{

long timestamp = GetTimestampInSeconds();

string nonce = GenerateNonce(6);

var uri = new UriBuilder(uriStr);

string host = uri.Host;

string port = uri.Port.ToString();

string resource = uri.Path + (uri.Query.Length > 0 ? uri.Query : "");

string options = GenerateNormalizedString("header", timestamp, nonce, method, resource, host, port, "");

string mac = GenerateRequestMac("header", key, options);

return $"Hawk id=\"{id}\", ts=\"{timestamp}\", nonce=\"{nonce}\", mac=\"{mac}\"";

}

}

```

```javascript

const Hawk = require("hawk");

/**

* The method to generate the hawk auth header

* @param uri The full uri of the request

* @param method The request method used

* @param options The request options including credentials

* @returns a Hawk authorization header including the Hawk Auth ID, time stamp, nonce, and MAC

*/

function hawkHeader(url, method, options) {

const { header } = Hawk.client.header(url, method, options);

return header;

}

// The credentials used to generate the Auth headers

const credentials = {

id: "<>",

key: "<>",

algorithm: "sha256", // The hashing algorith used.

};

// The request to be performed

const request = {

method: "GET",

url: "/api/v1/merchant",

host: "https://api.sandbox.bvnk.com",

};

console.log(

hawkHeader(`${request.host}${request.url}`, request.method, {

credentials,

})

);

```

```php

$timestamp,

'nonce' => generateNonce(6),

'method' => $method,

'resource' => parse_url($uri, PHP_URL_PATH) . (parse_url($uri, PHP_URL_QUERY) ? '?' . parse_url($uri, PHP_URL_QUERY) : ''),

'host' => parse_url($uri, PHP_URL_HOST),

'port' => parse_url($uri, PHP_URL_PORT) ?? (parse_url($uri, PHP_URL_SCHEME) === "http" ? 80 : 443),

];

// Generate the MAC

$mac = generateRequestMac("header", $credentials, $artifacts);

// Construct Authorization header

$header = 'Hawk id="' . $credentials['id'] . '", ts="' . $artifacts['ts'] . '", nonce="' . $artifacts['nonce'] . '", mac="' . $mac . '"';

return $header;

}

// The credentials used to generate the Auth headers

$credentials = [

'id' => "<>",

'key' => "<>",

'algorithm' => "sha256", // The hashing algorithm used.

];

// The request to be performed

$request = [

'method' => "GET",

'url' => "/api/v1/merchant",

'host' => "https://api.sandbox.bvnk.com",

];

// Print Hawk Auth header

echo hawkHeader($request['host'] . $request['url'], $request['method'], ['credentials' => $credentials]);

?>

```

```ruby

require 'openssl'

require 'base64'

require 'uri'

# Generates a timestamp of the current time in seconds

# @return [Integer] A timestamp in seconds

def get_timestamp_in_seconds

Time.now.to_i

end

# Creates a string of random alphanumeric characters

# @param length [Integer] The required length of the string

# @return [String] A string of random characters

def generate_nonce(length)

possible = ('A'..'Z').to_a + ('a'..'z').to_a + ('0'..'9').to_a

(0...length).map { possible[rand(possible.length)] }.join

end

# Generates a normalized string out of the header options

# @param type [String] The request type

# @param options [Hash] The options hash

# @return [String] A normalized string containing all parts to be hashed

def generate_normalized_string(type, options)

header_version = "1"

normalized = "hawk." +

header_version +

"." +

type +

"\n" +

options[:ts].to_s +

"\n" +

options[:nonce] +

"\n" +

(options[:method] || "").upcase +

"\n" +

(options[:resource] || "") +

"\n" +

options[:host].downcase +

"\n" +

options[:port].to_s +

"\n" +

(options[:hash] || "") +

"\n"

normalized += "\n"

normalized

end

# Generates the request Message Authentication Code (MAC) using the MAC-SHA256 hashing algorithm

# @param type [String] The type to generate

# @param credentials [Hash] The credentials used to generate the Auth header

# @param options [Hash] The options used to generate the code

# @return [String] a request MAC

def generate_request_mac(type, credentials, options)

normalized = generate_normalized_string(type, options)

hmac = OpenSSL::HMAC.new(credentials[:key], credentials[:algorithm])

hmac.update(normalized)

Base64.strict_encode64(hmac.digest)

end

# Generates the Hawk authentication header

# @param uri [String] A full URI string

# @param method [String] The HTTP method (GET, POST, etc.)

# @param options [Hash] Hash containing credentials and other options

# @raise [RuntimeError] If the provided arguments are of an invalid type.

# @return [String] The Hawk authorization header

def hawk_header(uri, method, options)

uri = URI(uri) if uri.is_a? String

timestamp = get_timestamp_in_seconds

credentials = options[:credentials]

if credentials.nil? || credentials[:id].nil? || credentials[:key].nil? || credentials[:algorithm].nil?

raise "Invalid credentials"

end

artifacts = {

ts: timestamp,

nonce: generate_nonce(6),

method: method,

resource: uri.path + (uri.query.nil? ? '' : "?#{uri.query}"),

host: uri.host,

port: uri.port || (uri.scheme == "http" ? 80 : 443)

}

mac = generate_request_mac("header", credentials, artifacts)

header = "Hawk id=\"#{credentials[:id]}\", ts=\"#{artifacts[:ts]}\", nonce=\"#{artifacts[:nonce]}\", mac=\"#{mac}\""

header

end

credentials = {

id: "<>",

key: "<>",

algorithm: "sha256",

}

request = {

method: "GET",

url: "/api/v1/merchant",

host: "https://api.sandbox.bvnk.com",

}

header = hawk_header("#{request[:host]}#{request[:url]}", request[:method], {

credentials: credentials

})

puts header

```

```python

# This function generates a timestamp of the current time in seconds

def get_timestamp_in_seconds():

return int(time.time())

# This function creates a string of random alphanumeric characters

def generate_nonce(length):

return ''.join(random.choice(string.ascii_letters + string.digits) for _ in range(length))

# This function generates a normalized string out of the header options

def generate_normalized_string(type, options):

header_version = "1"

normalized = f'hawk.{header_version}.{type}\n{options["ts"]}\n{options["nonce"]}\n{options["method"].upper()}\n{options["resource"]}\n{options["host"].lower()}\n{options["port"]}\n{options["hash"]}\n\n'

return normalized

# This method generates the request Message Authentication Code (MAC) using the MAC-SHA256 hashing algorithm

def generate_request_mac(type, credentials, options):

normalized = generate_normalized_string(type, options)

hmac_obj = hmac.new(credentials['key'].encode(), normalized.encode(), hashlib.sha256)

return base64.b64encode(hmac_obj.digest()).decode()

# This method generates the Hawk authentication header

def hawk_header(uri, method, options):

# Validate inputs

if not uri or not isinstance(uri, str) or not method or not isinstance(method, str) or not options or not isinstance(options, dict):

raise ValueError("Invalid argument type")

# Application time

timestamp = get_timestamp_in_seconds()

# Validate credentials

credentials = options['credentials']

if not credentials or not credentials['id'] or not credentials['key'] or not credentials['algorithm']:

raise ValueError("Invalid credentials")

# Parse URI if it is a string

parsed_uri = urllib.parse.urlparse(uri)

# Prepare artifacts object to be used in MAC generation

artifacts = {

'ts': timestamp,

'nonce': generate_nonce(6),

'method': method,

'resource': parsed_uri.path + parsed_uri.query, # Maintains trailing '?'

'host': parsed_uri.hostname,

'port': parsed_uri.port if parsed_uri.port else (80 if parsed_uri.scheme == 'http' else 443),

'hash': ''

}

# Generate the MAC

mac = generate_request_mac('header', credentials, artifacts)

# Construct Authorization header

header = f'Hawk id="{credentials["id"]}", ts="{artifacts["ts"]}", nonce="{artifacts["nonce"]}", mac="{mac}"'

return header

# The credentials used to generate the Auth headers

credentials = {

'id': "<>",

'key': "<>",

'algorithm': "sha256", # The hashing algorithm used.

}

# The request to be performed

request = {

'method': "GET",

'url': "/api/v1/merchant",

'host': "https://api.sandbox.bvnk.com",

}

print(hawk_header(f'{request["host"]}{request["url"]}', request["method"], {'credentials': credentials}))

```

```node

const crypto = require("crypto");

const generateHawkAuthorization = (url, method, hawkId, hawkSecret) => {

// Generate Hawk authorization header

const timestamp = Math.floor(Date.now() / 1000);

const nonce = Math.random().toString(36).substring(7);

const parsedUrl = new URL(url);

const path = parsedUrl.pathname + parsedUrl.search;

const host = parsedUrl.host;

const port = parsedUrl.port || (parsedUrl.protocol === 'https:' ? '443' : '80');

// Create normalized request string

const normalized = `hawk.1.header\n${timestamp}\n${nonce}\n${method}\n${path}\n${host}\n${port}\n\n\n`;

// Generate MAC

const mac = crypto.createHmac('sha256', hawkSecret)

.update(normalized)

.digest('base64');

// Format Hawk header

return `Hawk id="${hawkId}", ts="${timestamp}", nonce="${nonce}", mac="${mac}"`

}

```

:::warning

The HTTP method and endpoint URL significantly influence the generation of the correct hash values in your authorization header. It's crucial to ensure these values are dynamically updated to align with your actual requests. Otherwise, your requests may fail.

:::

---

## Errors

The BVNK API responds with detailed information in the event of a failed request. Below is a comprehensive list of payment error codes, along with brief descriptions on how to address them. This resource serves as a valuable reference for developers, enabling them to efficiently troubleshoot and address errors in their applications' integration with BVNK's API.

The errors are returned in the following format:

```json Example Response for Payouts

{

"code": "bvnk:payment:0005",

"status": "Bad Request",

"message": "Beneficiary details validation failed",

"details": {

"documentLink": "../api-overview/errors",

"errors": {

"requestBody": [

"Address country required"

]

}

}

}

```

```json Array of Errors

{

"requestId": "cd8b277efeeccdea4067a4030ecc4e45",

"errorList": [

{

"requestId": null,

"code": "MER-PAY-2012",

"parameter": "amount",

"message": "insufficient funds"

}

]

}

```

Here,

* `code`: Error code that identifies the specific error type. See the list of codes and descriptions below.

* `status`: HTTP status associated with the error, such as`400`, `403`.

* `message`: Human-readable explanation of the error and guidance on how to resolve it. In most cases, error details are propagated into this field (often similar to `details.error`).

* `details`: Structured information about why the request failed. This field is most common for Bad Request (400) errors, but it can be null when the details have been propagated to the message or are otherwise unavailable.

For example, the above payout response appears if you specify `countryCode: null` in the request. The `requestBody` contains specific information about the missing field.

* `details.documentLink`: Link to this article where you can learn more about the caught error.

## 0001-0099

### Fiat payouts

| **Code** | **Message** | **Description** |

| :-------: | :---------- | :----------------- |

| BVNK:PAYMENT:0001 | Received Bad Request | The system received a request with invalid parameters or missing required information. Check the request format, parameters, and ensure all required fields are correctly filled. |

| BVNK:PAYMENT:0002 | Payout with the given identifier could not be found | The system was unable to locate the requested payout using the provided ID. Verify that the payout ID is correct and exists in the system. |

| BVNK:PAYMENT:0003 | Forbidden → received request with wrong authentication details | The request was rejected due to an authentication failure. Ensure your API keys, tokens, or credentials are valid and correctly included in the request header. |

| BVNK:PAYMENT:0004 | Error while receiving or validating beneficiary | The beneficiary details could not be retrieved, or failed validation checks. This may occur due to missing or malformed fields (name, address, account identifiers), failed KYC/KYB or sanctions screening, or temporary downstream connectivity errors. Verify beneficiary data to ensure the required fields and formats (e.g., IBAN/ABA) are accurate. Confirm the beneficiary is allowed, and retry once issues are resolved. |

| BVNK:PAYMENT:0005 | Validation of the beneficiary has failed | The beneficiary did not pass mandatory validation rules. Typical reasons include invalid account identifiers, an unsupported destination, a mismatched currency/network, or a compliance screening failure. Correct the beneficiary information (names, address, account numbers, tags/memos where required) or select a different, validated beneficiary before retrying. |

| BVNK:PAYMENT:0006 | Payout with the idempotency key already exists | A payout using the provided idempotency key already exists. For idempotent safety, the platform rejects creating a new payout with the same key. If you intend to retry the same request, use the original response; otherwise, generate a new, unique idempotency key for a new payout. |

| BVNK:PAYMENT:0007 | Insufficient funds | A wallet does not have sufficient funds to complete the requested transaction. |

| BVNK:PAYMENT:0008 | The payment method is not supported | The platform does not currently support the payment method specified in the request. Review the documentation for a list of supported payment methods. |

| BVNK:PAYMENT:0009 | Specific functionality is not enabled for this account or wallet | The specific functionality or flow is not enabled or provisioned for this account or wallet. Check your permissions and product enablement. If the feature is available, enable it in the portal; otherwise, contact support to request access. |

| BVNK:PAYMENT:0010 | The virtual account has been disabled for this given wallet. Customer should use a different wallet or choose different payment method. | The virtual account assigned to the specified wallet is disabled. Use a different wallet or select an alternative payment method. If you need this virtual account re-enabled, review the wallet configuration and contact support or your account manager. |

| **Mass Payouts** | | |

| BVNK:PAYMENT:0030 | Could not find a single payment within a given payout batch | The referenced payout batch contains no payments matching your query, or the payments have not been associated with the batch yet. Verify the payout batch identifier, ensure the batch was created successfully, and confirm that items were added and not removed by validation. If you are filtering, check the date/status filters to ensure you are querying the correct environment (sandbox vs. production). |

| BVNK:PAYMENT:0031 | Could not find specific payout batch | The payout batch could not be located. The batch identifier may be invalid, belong to another account, or the batch may have been archived/expired. Double-check the batch ID/token and your account permissions, then try again. If the batch was created recently, allow a short delay and retry. |

| BVNK:PAYMENT:0032 | Cannot delete a single payout from a batch, as it has started processing already | Once batch processing has started, individual payouts become immutable. Deletions are only permitted while the batch is in a pre‑processing state. To remove items, cancel the whole batch if supported, or create a new batch without the unwanted payout. |

| BVNK:PAYMENT:0033 | Cannot update a single payout from a batch, as it has started processing already | Individual payout updates are blocked after batch processing begins. Modify items only before submission. If you need changes, cancel the batch (where supported) and recreate it with corrected payout details, or submit a follow‑up adjustment as a new payout. |

### Fees

| **Code** | **Message** | **Description** |

| :-----------------: | :------------------------------------------------ | :-------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| BVNK:FEES:0001 | Invalid wallet selected on client request. | The wallet selected in the client request is invalid. Check that the wallet identifier is correctly formatted and belongs to a valid wallet type. |

| BVNK:FEES:0002 | Provided wallet not found for a specific account. | The system was unable to find the specified wallet associated with the requested account. Verify that the wallet exists and is correctly linked to the account. |

| BVNK:FEES:0003 | Invalid customer fee wallet configuration. | The customer fee wallet configuration contains invalid settings or parameters. Review and correct the fee wallet configuration in your account settings. |

***

## 1000-1999

| **Code** | **Message** | **Description** |

| :---------------: | :------------------------------------ | :---------------------------------------------------------------------------------------------------------------------------------------------------------- |

| MER-PAY-1000 | Not authorized to perform this action | A user or merchant is not authorised to perform the requested action. This can occur due to insufficient permissions or invalid authentication credentials. |

***

## 2000-2999

:::warning

Should you encounter any of the errors outlined in this section, be aware that your payment or transaction attempt will not be successful. The system will reject the transaction at the API level, consequently preventing the creation of a failed transaction record. Therefore, you will not find any evidence of the unsuccessful operation within the Portal.

:::

| **Code** | **Message** | **Description** |

| :---------------: | :--------------------------------------------------------------------------------------------------------------------------------------- | :---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| MER-PAY-2000 | Invalid parameter value | The request parameters fail validation. This includes JSON parsing errors, missing required parameters, invalid data types, or constraint violations on request fields. |

| MER-PAY-2001 | Amount x.xx \ failed is less than minimum limit of x.xx \ | The payment amount fails validation. This occurs when the amount is below the minimum limit or above the maximum limit for the specified currency. |

| MER-PAY-2002 | Payment has no quote | An error occurs when a payment operation requires an exchange quote, but none is found. This typically occurs when attempting to process payments that require currency conversion. |

| MER-PAY-2003 | Exchange quote \ for payment \ has status ACCEPTED so cannot be accepted | An error is given when attempting to modify a quote that has already been finalised. Once a quote is in a final state, it cannot be changed. |

| MER-PAY-2004 | Payment has expired | An error occurs when attempting to process a payment that has exceeded its expiration time. Expired payments cannot be processed and need to be recreated. |

| MER-PAY-2005 | Instruction validation failed message | The payment instruction data is invalid. This includes validation failures for payment addresses, amounts, or other instruction-specific parameters. |

| MER-PAY-2006 | Merchant not found | An error occurs when the Merchant ID provided in the payment request cannot be found in the account. |

| MER-PAY-2008 | Payment not found | An error occurs when the payment ID cannot be found. |

| MER-PAY-2009 | Invalid request message | Error given for general request validation failures. |

| MER-PAY-2010 | A payment with reference \ already exists. Please enter a unique reference. | An error was given when a payment was already created using this reference. All references need to be unique. |

| MER-PAY-2011 | Currency \ is disabled | An error occurs when creating a payment with a disabled currency that is not available for trade. |

| MER-PAY-2012 | Insufficient funds | A wallet does not have sufficient funds to complete the requested transaction. |

| MER-PAY-2014 | Exchange quote \ for payment \ can no longer be accepted as acceptance has expired | A quote is accepted after it has expired. |

| MER-PAY-2015 | Crypto instruction not found for payment \ | A required crypto payment instruction cannot be found for the specified payment. |

| MER-PAY-2016 | Merchant not authorised to perform this action | A merchant is not authorised to perform the requested action. |

| MER-PAY-2017 | Cannot cancel payment with external id \ and status PROCESSING | An attempt is made to cancel a payment and the status is not COMPLETE or PENDING. |

| MER-PAY-2018 | Resource modified by another request | A concurrent modification conflict arises. This happens when multiple requests attempt to modify the same resource simultaneously. |

| MER-PAY-2019 | Currency \ not found | The specified currency is not found in the system. |

| MER-PAY-2024 | protocol \ not found for currency \ | The specified protocol is not found or not supported for the given currency. |

| MER-PAY-2025 | Please enter your own wallet address, not the address that you paid into originally. | The provided refund address fails validation checks. |

| MER-PAY-2027 | address \ has failed validation for currency: \, protocol: \ and tag: \ | The crypto payout receive address format is invalid. |

| MER-PAY-2028 | We couldn't process your payout request to this address: \ this time, please try another address. | The crypto payout receiving address is rejected due to risk and compliance reasons. |

| MER-PAY-2029 | Protocol with code \ not found | The specified protocol code is not found in the system. |

| MER-PAY-2030 | Unable to find protocol \ for currency code \ | The specified protocol cannot be found for the given currency code. |

| MER-PAY-2031 | Account not enabled for flow: \. Please check your permissions or contact support for more information. | The account is not enabled for the specific payment flow being requested. |

| MER-PAY-2033 | Multiple protocols found for currency \ Please specify which one to use: \. | Multiple protocols are available for a currency, but no specific protocol is selected, rendering automatic selection impossible. |

| MER-PAY-2035 | mass payout data row validation failed | One or more rows in a mass payout file fail validation checks. |

| MER-PAY-2036 | \ payments uploaded. This exceeds the maximum number of \ rows. Please reduce your file to \ rows. | A mass payout file contains more rows than the system maximum allows. |

| MER-PAY-2037 | Failed to process mass upload file. File name already exists. | Attempting to upload a mass payout file with a filename that already exists. |

| MER-PAY-2038 | Failed to process mass upload file. File is required. | A required mass payout file is not provided. |

| MER-PAY-2039 | Failed to process mass upload file. One of Merchant id or Wallet id fields have to be provided. | A mass payout request is missing both the required merchant ID and wallet ID parameters. |

| MER-PAY-2040 | Failed to process mass upload file. Header is invalid. | The mass payout file contains invalid or missing required headers. |

| MER-PAY-2041 | Deleting mass payout item with status CREATED is not allowed. | An error is given when attempting to delete a mass payout item that is not in a deletable state. |

| MER-PAY-2042 | Updating mass payout item with status \ is not allowed. | An error is given when attempting to edit a mass payout item that is not in an editable state. |

| MER-PAY-2043 | One of merchantId or walletId properties have to be provided, both are missing | A request requires a merchant ID or a wallet ID, but neither is provided. |

| MER-PAY-2044 | network \ not found | The specified blockchain network is not valid or supported. |

| MER-PAY-2045 | Payout details currency \ and network \ mismatch from previously provided currency \ and network \ | The payout details do not match the details previously provided for the estimate. |

| MER-PAY-2046 | protocol not found for currency \ and network \ | The specified protocol and network combination is not valid or supported. |

| MER-PAY-2047 | Estimate cannot be modified. Payment with uuid \ already created for estimate \. | An error is given when attempting to accept an estimate that already has an associated payment. |

| MER-PAY-2048 | Failed to process mass upload file. File is empty. | The uploaded mass payout file contains no data rows. |

| MER-PAY-2049 | Recipient address is not associated with a contact. You will assign or add a contact to it on the next step. | The specified contact cannot be found for the given address or criteria. |

| MER-PAY-2050 | Recipient address is associated with more than 1 contact. You'll be asked to choose which contact to use for this transaction. | Multiple matching contacts are found for the provided address. |

| MER-PAY-2051 | Crypto account \ is not verified. Please verify your crypto account before using it | An error occurs when attempting to use an unverified cryptocurrency account that requires verification. |

| MER-PAY-2052 | This country is unavailable. If you require this region, please reach out to your account manager. | Geographical screening encounters an error or fails due to regional restrictions. |

| MER-PAY-2053 | The payment can not be processed. | Geographical screening determines that the payment cannot be processed due to regional restrictions. |

| MER-PAY-2054 | Payment direction 'IN' is not compatible with flow 'EMBEDDED_CRYPTO' | An error is given when attempting to use an unsupported payment direction with an embedded crypto flow. |

| MER-PAY-2055 | mesh client invalid request message | A request to the mesh client is invalid or malformed. |

| MER-PAY-2056 | Customer not found for reference: \ | The specified customer cannot be found in the system. |

| MER-PAY-2057 | required header missing | A required HTTP header is missing from the request. |

| MER-PAY-2058 | Cannot confirm/accept payment \ as it has been cancelled | An error is given when attempting to perform operations on a payment that has been cancelled. |

| MER-PAY-2059 | Wallet with ID \ not found | The specified wallet ID does not exist. |

***

## 3000-3999

### Network

| **Code** | **Message** | **Description** |

| :------------: | :------------------------------------------------------------- | :---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| BVNK-3001 | Received Bad Request | The system received a request with invalid parameters or missing required information. Check the request format, parameters, and ensure all required fields are properly filled and formatted correctly. |

| BVNK-3003 | Forbidden → received request with wrong authentication details | Access to the requested resource is denied due to authentication failure. Ensure your API keys, tokens, or credentials are valid, correctly included in the request header, and have the necessary permissions to perform this operation. |

| BVNK-3040 | Transfer not found | The requested transfer could not be located in the system. Verify that the transfer identifier is correct and exists within your account. If you recently initiated the transfer, it may still be processing. |

### Customers

| **Code** | **Message** | **Description** |

| :--------------- | :---------------------------------------------- | :------------------------------------------------------------------------ |

| MER-PAY-3003 | Resource not found | Error given when a requested static resource or endpoint cannot be found. |

| MER-PAY-3XXX | Unexpected error - please contact administrator | Error given for unexpected or unhandled exceptions. |

***

## 4001-4999

### Wallets

| **Code** | **Message** | **Description** |

| :-------------------: | :----------------------------------------------------------------------------------------------------------------- | :----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| BVNK:LEDGER:4001 | Received Bad Request | The system received a request with invalid parameters or missing required information. Check the request format, ensure all required fields are properly filled, and validate that parameter values meet the expected format and constraints. |

| BVNK:LEDGER:4003 | FORBIDDEN! You don't have the necessary permissions to access this resource. | Access to the requested resource is denied due to insufficient permissions. This could be due to missing capabilities when creating a customer wallet, or because the customer has been rejected in the system. Verify your account permissions and customer status before retrying. |

| BVNK:LEDGER:4004 | Wallet creation request with the same idempotency key and account reference exists | A wallet creation request with the same idempotency key and account reference already exists in the system. Idempotency keys must be unique for each new wallet creation. Check your records to find the existing wallet or use a new idempotency key for a new wallet. |

| BVNK:LEDGER:4005 | Wallet creation request with missing data, one of the customer reference and external reference has to be provided | The wallet creation request is missing essential identifying information. Either a customer reference or an external reference must be provided in the request. Review your request data and include at least one of these required reference identifiers. |

### Customers

| **Code** | **Message** | **Description** |

| :---------------: | :---------------------------------------------------------------------------- | :------------------------------------------------------------- |

| MER-PAY-4011 | Customer fee wallet not found. Please contact support if you need assistance. | The customer fee wallet has not been set. Configuration error. |

| MER-PAY-4XXX | Unexpected error - please contact administrator | Error given for unexpected or unhandled exceptions. |

### Rules

| Error Code | Message | Description |

| ---------------------------: | ----------------------------------- | ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| bvnk:payment:rules:4001 | Wallet configuration already exists | A wallet configuration with the specified parameters already exists in the system. This error occurs when attempting to create a duplicate wallet configuration that conflicts with an existing one. |

| bvnk:payment:rules:4002 | Address validation error | The provided wallet address failed validation checks. This error indicates that the address format is invalid, doesn't match the expected format for the specified network, or contains invalid characters. |

| bvnk:payment:rules:4003 | Invalid currency | The specified currency code is not recognized or supported by the system. Ensure you're using a valid currency identifier that matches the supported currencies for your account. |

| bvnk:payment:rules:4004 | Unsupported network | The blockchain network specified in the request is not supported by the payment rules system. Check the list of supported networks and use a valid network identifier. |

| bvnk:payment:rules:4005 | Invalid party details | The party details provided in the request contain invalid or missing information. This includes issues with party identification, contact information, or other required party-specific data. |

| bvnk:payment:rules:4006 | Data integrity violation | A data integrity constraint has been violated. This error occurs when the provided data conflicts with existing database constraints or business rules that ensure data consistency. |

| bvnk:payment:rules:4007 | Invalid fee type | The fee type specified in the request is not valid or supported. Check the documentation for valid fee type values and ensure you're using the correct fee structure for your configuration. |

| bvnk:payment:rules:4008 | Invalid destination type | The destination type provided is invalid or not supported for the current operation. Verify that you're using a supported destination type for your wallet configuration. |

| bvnk:payment:rules:4016 | Invalid request format | The request format is malformed or contains invalid structure. This error indicates issues with JSON formatting, missing required fields, or incorrect data types in the request payload. |

| bvnk:payment:rules:4009 | Wallet not found | The specified wallet could not be found in the system. Verify that the wallet ID or identifier exists and that you have the necessary permissions to access it. |

| bvnk:payment:rules:4010 | Wallet configuration not found | The requested wallet configuration does not exist. This error occurs when trying to access, modify, or delete a wallet configuration that is not present in the system. |

| bvnk:payment:rules:4011 | Wallet configuration already active | The wallet configuration is already in an active state and cannot be modified or activated again. Check the current status of the configuration before attempting to change it. |

| bvnk:payment:rules:4012 | Currency mismatch | There is a mismatch between the expected currency and the provided currency. Ensure that all currency references in your request are consistent and match the wallet's configured currency. |

| bvnk:payment:rules:4013 | Wallet status validation error | The wallet status validation failed. This error occurs when the current wallet status doesn't allow the requested operation or when the wallet is in an invalid state for the action being performed. |

| bvnk:payment:rules:4014 | Wallet configuration state error | The wallet configuration is in an invalid state for the requested operation. This may occur when trying to perform actions on configurations that are pending, disabled, or in transition states. |

| bvnk:payment:rules:4015 | Invalid customer fee configuration | The customer fee configuration contains invalid parameters or values. Check that fee amounts, percentages, and fee structure parameters are within acceptable ranges and properly formatted. |

## 5000-5999

### Wallets

| **Code** | **Message** | **Description** |

| :-------------------: | :----------------------- | :----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| BVNK:LEDGER:5001 | Wallet not found | The requested wallet could not be located in the system. Verify that the wallet identifier is correct and exists within your account. |

| BVNK:LEDGER:5050 | Wallet balance not found | The system could not retrieve balance information for the specified wallet. Ensure the wallet exists and has been properly initialized with a balance. |

| BVNK:LEDGER:5040 | Bad Request | The request contained invalid data, malformed parameters, or violated validation constraints. Review your request format and ensure all required fields contain valid data. |

| BVNK:LEDGER:5051 | Wallet creation failed | The wallet creation process failed to complete successfully. This could be due to system constraints, validation issues, or conflicts with existing data. Check the request details and try again with valid parameters. |

### Customers

| **Code** | **Message** | **Description** |

| :---------------: | :-------------------------------------------------------------------------------------------------------------------------------------------------------- | :---------------------------------------------------------------------------- |

| MER-PAY-5001 | The requested wallet could not be located in the system. | Verify that the wallet identifier is correct and exists within your account. |

| MER-PAY-5050 | The system could not retrieve balance information for the specified wallet. | Ensure the wallet exists and has been properly initialized with a balance. |

| MER-PAY-5040 | The request contained invalid data, malformed parameters, or violated validation constraints. | Review your request format and ensure all required fields contain valid data. |

| MER-PAY-5051 | The wallet creation process failed to complete successfully. This could be due to system constraints, validation issues, or conflicts with existing data. | Check the request details and try again with valid parameters. |

### Rules

| **Code** | **Message** | **Description** |

| :--------------------------: | :---------------------- | :--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| bvnk:payment:rules:5001 | Feature not implemented | The requested feature or functionality is not yet implemented in the current version of the payment rules system. This feature may be available in future releases. |

| bvnk:payment:rules:5003 | Wallet validation error | Wallet validation services are currently unavailable. This error indicates a temporary issue with external validation services or network connectivity problems affecting wallet verification. |

| bvnk:payment:rules:5004 | Internal error | An unexpected internal server error occurred while processing the request. This indicates a system-level issue that should be reported to technical support for investigation. |

---

## Idempotency

Some API endpoints support idempotency, allowing you to safely retry requests without duplicating actions.

To use this feature, include an `X-Idempotency-Key` header in your request. The key must be a unique, UUID-formatted 36-character alphanumeric value.

A request with a new idempotency key will be processed. If you resend the same request with identical credentials and idempotency key, BVNK returns a 400 `Bad Request` status and indicates that a request with this ID already exists. This feature is especially useful for critical operations such as transferring funds, creating payment orders, or updating resources.

For example, if a payment order request times out due to a network issue, you can repeat the call with the same idempotency key to ensure only one payment order is created. Only successful requests are cached. Failed requests are not stored, so you can retry them without risk of conflict.

```curl Idempotent Request

curl --request POST \

--url https://api.sandbox.bvnk.com/ledger/v1/wallets \

--header 'X-Idempotency-Key: 1e74002e-74a1-48fd-b707-147c3187a3e1' \

--header 'accept: application/json' \

--header 'content-type: application/json' \

--data '

```

:::info For v.2 endpoints, use `Idempotency-Key` header instead of `X-Idempotency-Key`.

```bash

curl --request POST \

--url https://api.sandbox.bvnk.com/payment/v2/transfers \

--header 'Idempotency-Key: 1e74002e-74a1-48fd-b707-147c3187a3e1' \

--header 'accept: application/json' \

--header 'content-type: application/json' \

--data '

```

:::

---

## Metadata

You can include custom metadata in some requests. For example, in the payout requests the metadata will be associated with the payout and included in webhook events related to this payout.

To add metadata, include a top-level JSON object with the key `metadata`. The value of this key should be another JSON object containing your desired key-value pairs.

```json Example Request with Metadata

{

...

"customerId": "ba388054-4512-441e-a9c4-cbe9b0fe0332",

"metadata": {

"orderId": "PO-2025-001",

"internalUserId": "user-456",

"reason": "Customer withdrawal"

}

}

```

When adding metadata to your request, keep the following in mind:

* You can include up to 10 separate key-value pairs.

* Each metadata key and value must have at least one character.

* Each metadata key can be up to 40 characters long. Each value can contain a maximum of 255 characters.

* Metadata keys can only contain:

* Uppercase letters (A-Z)

* Lowercase letters (a-z)

* Numbers (0-9)

* Underscores (\_)

* Hyphens (-)

* Metadata values cannot contain the characters "\<>".

The provided metadata will also be returned in the status endpoint for reference.

---

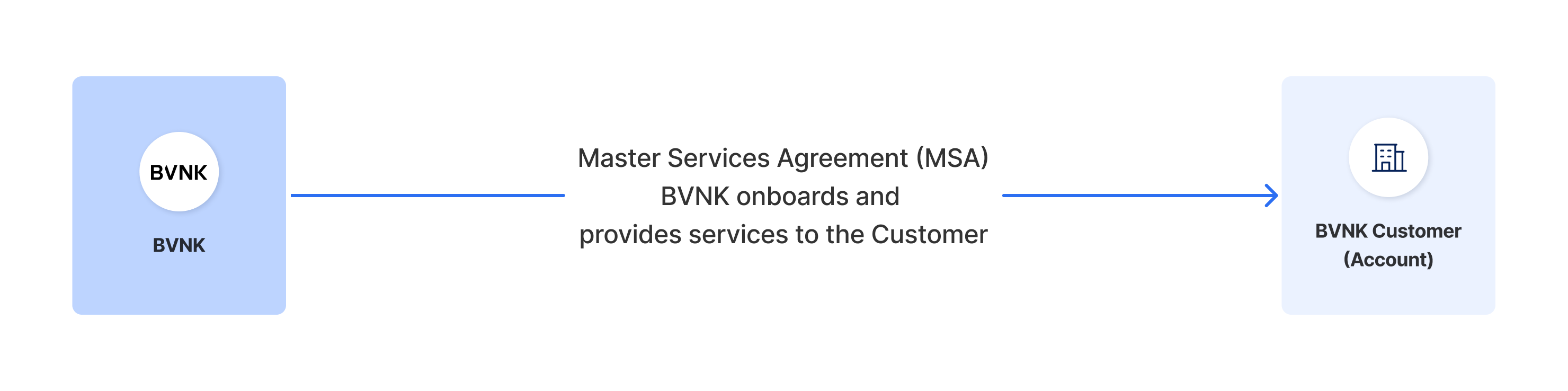

## Overview

The BVNK RESTful API is designed to enable seamless and secure transactions, including payments, channels, and digital wallet operations. The API operates over HTTP, and all requests and responses are formatted as JSON objects.

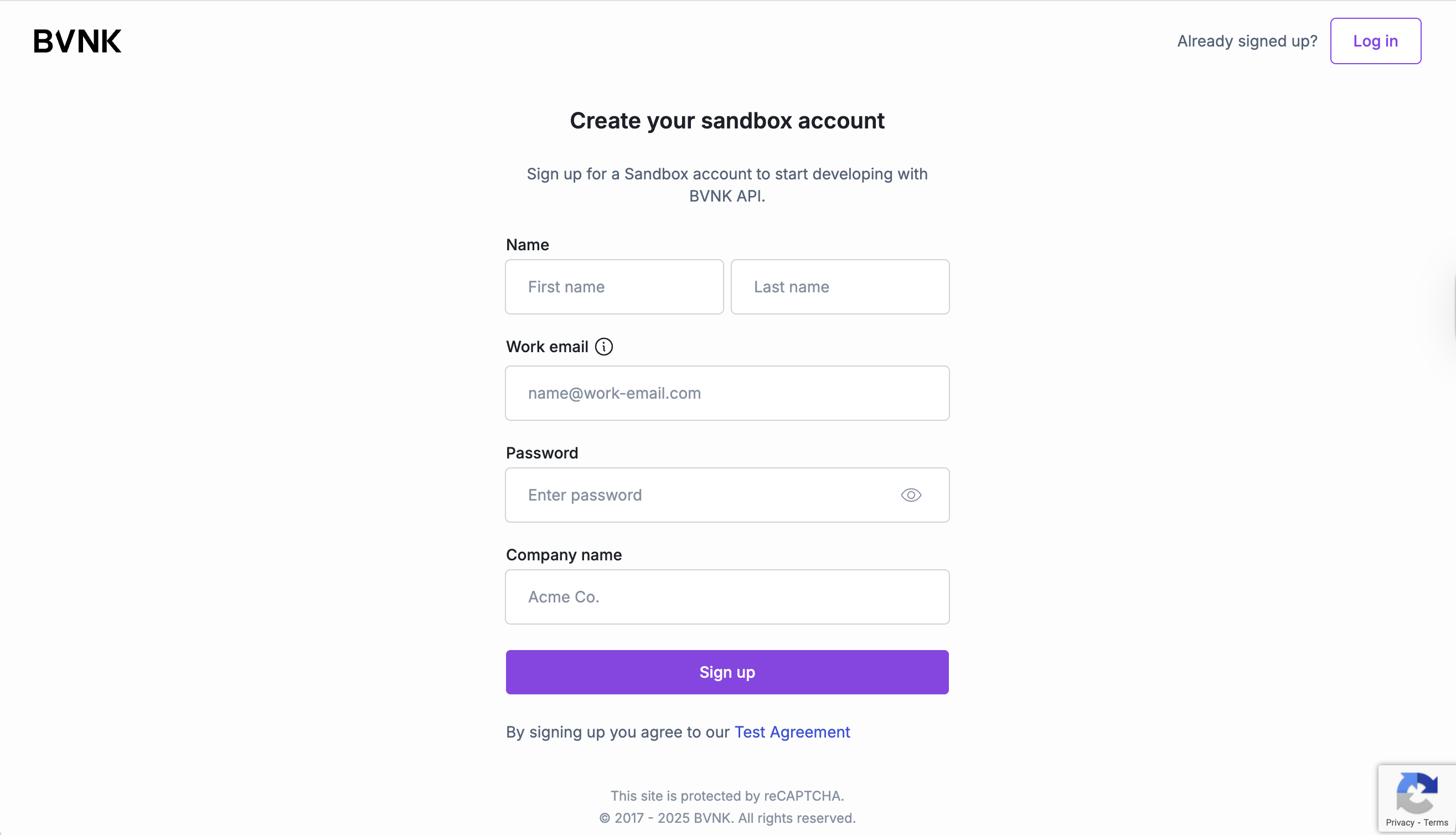

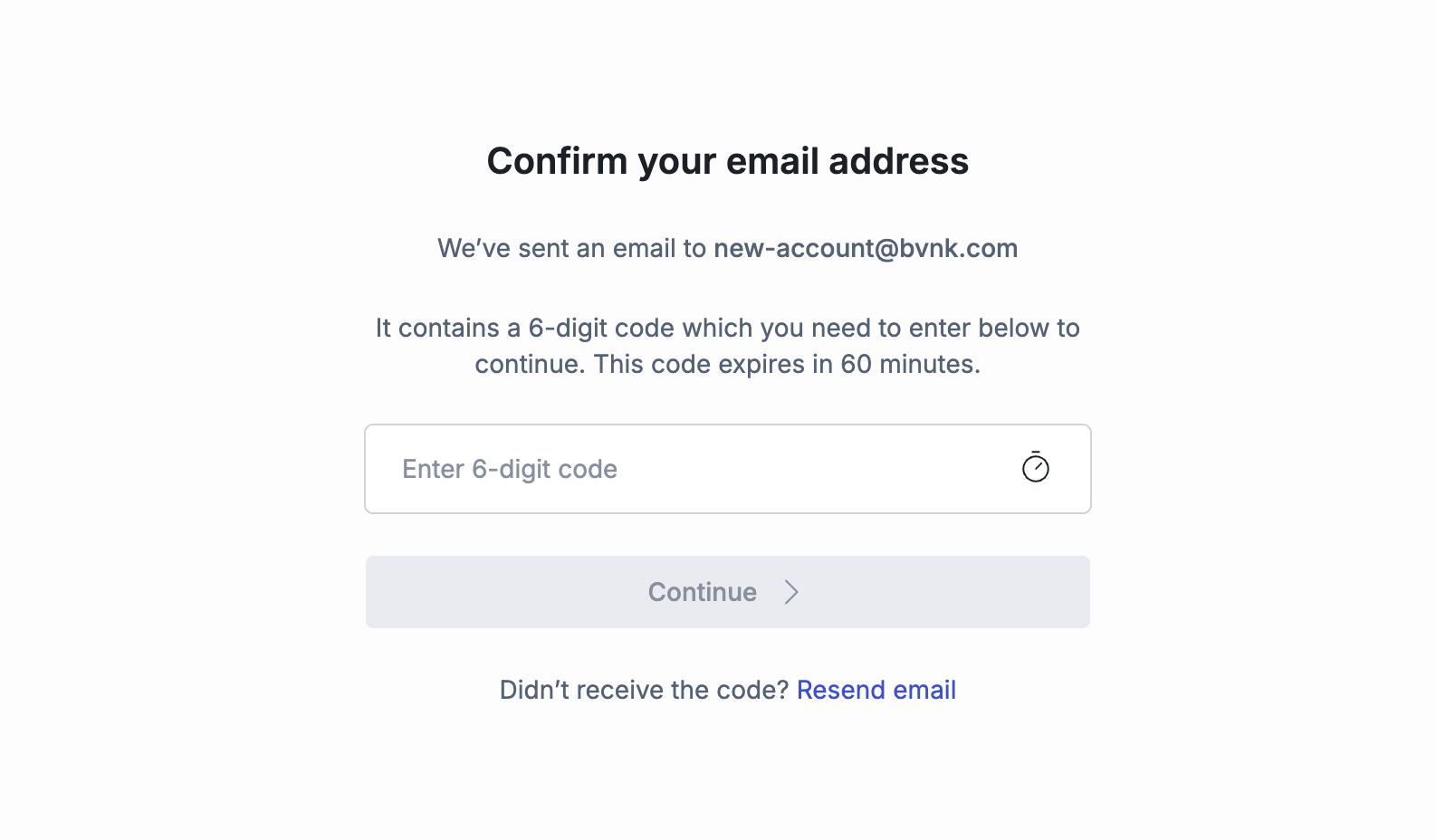

To gain access to the API, create an account on the BVNK Portal. Once you've completed the signup process and acknowledged our terms, create API keys (Hawk Auth ID and Secret Key).

BVNK API has two environments:

* Production: [https://api.bvnk.com/](https://api.bvnk.com/)

* Sandbox: [https://api.sandbox.bvnk.com/](https://api.sandbox.bvnk.com/)

Note that items cannot be transferred between these environments. The sandbox environment is limited to test your integration safely before going live. You can request access to the Production API via the Portal.

---

## Pagination

By default, most of the "List" endpoints return paginated results. Use the query parameters `page` and `size` to control the number of results displayed.

```curl Pagination Example

curl --request GET \

--url 'https://api.sandbox.bvnk.com/ledger/v1/wallets? page=2&size=30&sort=currencyCode%2Cdesc&offset=1' \

--header 'accept: application/json'

```

| Parameter | Description |

| :-------- | :--------------------------------------------------------------------------------------------- |

| `page` | Page number. Starts from "0". |

| `size` | Number of records on the page returned in the response. Maximum number: 100. Example, `2`. |

| `sort` | Sorting criteria. Format: `property,`. Default sort order is ascending. |

| `offset` | Starting point for pagination. Use instead of `page`, for example for cursor-based pagination. |

In the response, the `pageable` object may be returned. The object provides detailed info on the pagination.

```json

{

"pageable": {

"pageNumber": 0,

"pageSize": 20,

"sort": {

"empty": true,

"unsorted": true,

"sorted": false

},

"offset": 0,

"paged": true,

"unpaged": false

},

"last": true,

"totalPages": 1,

"totalElements": 2,

"first": true,

"size": 20,

"number": 0,

"sort": {

"empty": true,

"unsorted": true,

"sorted": false

},

"numberOfElements": 2,

"empty": false

}

```

| Attribute | Description |

| ------------------ | -------------------------------------------------------------------------------------------------------------- |

| `pageNumber` | Current page number, for example, `0` for the first page. |

| `pageSize` | Number of records per page, for example, `2`. |

| `sort.empty` | Indication whether the sort criteria is empty. `true` means no sorting. |

| `sort.sorted` | Indication whether the results are sorted. `false` means no sorting. |

| `sort.unsorted` | Indication whether the results are unsorted. `true` means no sorting. |

| `offset` | Offset of the first record, for example, `0`, which means no offset is applied. |

| `paged` | Indication whether the results are paginated. `true` for paginated. |

| `unpaged` | Indication whether the results are not paginated (false). |

| `last` | Indication whether this is the last page of results. `false` means there are more pages after the current one. |

| `totalPages` | Total number of pages, for example, `10`. |

| `totalElements` | Total number of elements across all pages, foe example, `20` elements. |

| `first` | Indication whether this is the first page. `true` for yes. |

| `size` | Number of elements per page, for example, `2`. |

| `number` | Current page number, foe example, `0` for the first page. |

| `sort.empty` | Indication whether the sort criteria is empty. `true` means no criteria. |

| `sort.sorted` | Indication whether the results are sorted. (false). |

| `sort.unsorted` | Indication whether the results are unsorted. `true` for unsorted. |

| `numberOfElements` | Number of elements on the current page, for example, `2` items. |

| `empty` | Indication whether the page is empty. `false` means the page contains elements. |

---

## Postman Collection

You can easily test our API before you start developing your app using our Postman Collection.\

This usually helps out immensely prior to any development process has even started.

[Download the Postman app](https://www.postman.com/downloads/) and fork the collection directly by clicking the button below:

## How to setup the collection

1. Choose Environments -> BVNK Public Environment

2. Enter the relevant HAWK AUTH ID and HAWK AUTH KEY that were displayed when you created your API keys

## Pick an API action from the list

To test individual endpoints and send requests, explore them on the left-hand side of your Postman.

---

## BVNK API Endpoints

The BVNK API is designed to facilitate seamless and secure transactions including payments, channels, and digital wallet transactions.

Hawk Payload (see: https://github.com/hueniverse/hawk)

Security Scheme Type:

apiKey

Header parameter name:

Authorization

Bearer token for authentication.

Security Scheme Type:

http

HTTP Authorization Scheme:

bearer

Bearer format:

JWT

---

## Create Channel

Creates a channel that your end users can openly send payments to.

---

## List Channels

Retrieves all channels related to a Wallet ID.

---

## List Channel Payments

Retrieves a list of payments to a channel on a specific Wallet ID.

---

## Get Channel Payment

Retrieves a specific payment made into a channel.

---

## Get Channel

Retrieves a specific channel by its UUID.

---

## Get Channel Spot Rate

Poll the current spot rate for a channel. Use this endpoint if you are building your own UI and need to display the live conversion rate to customers.

---

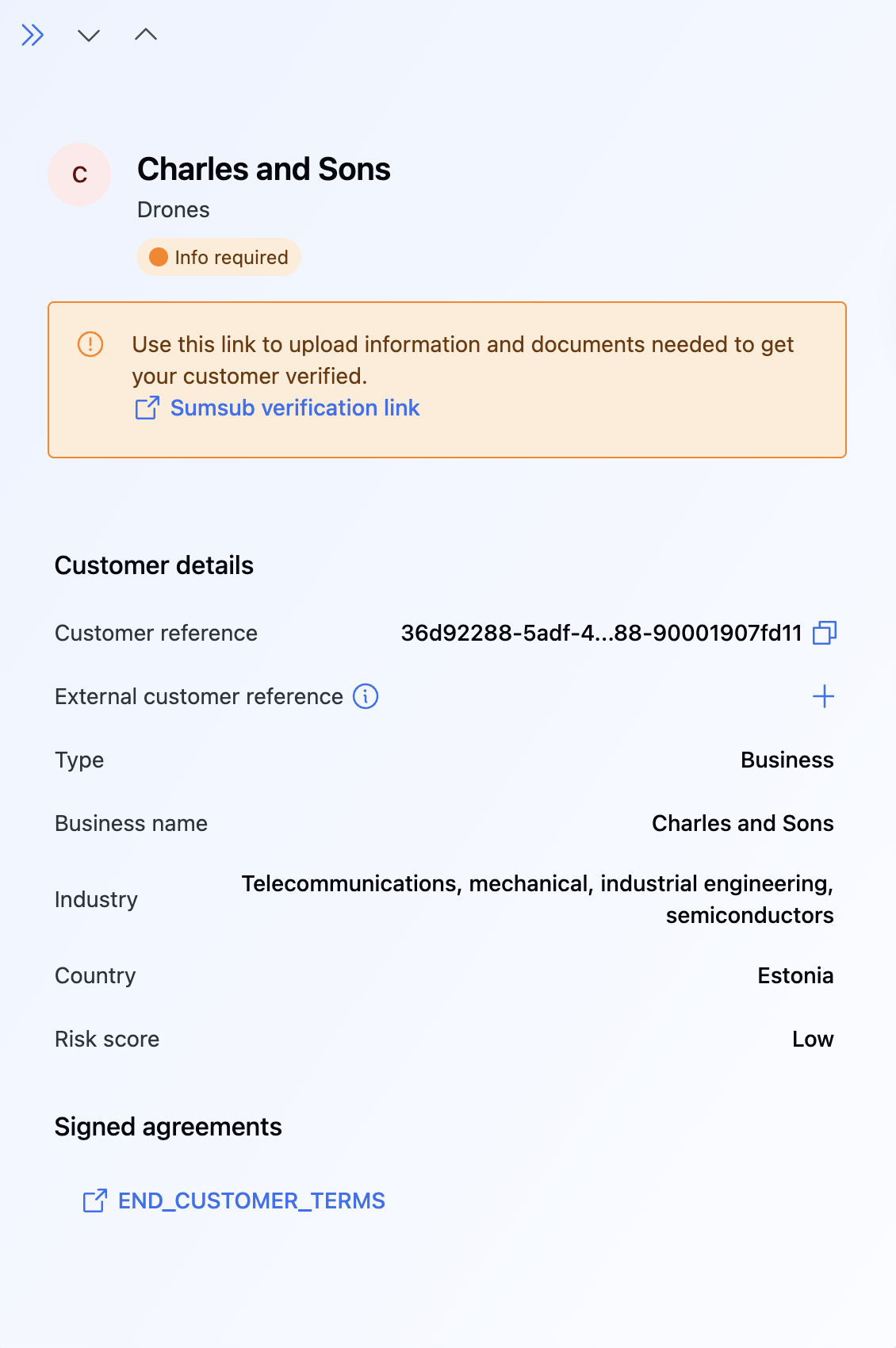

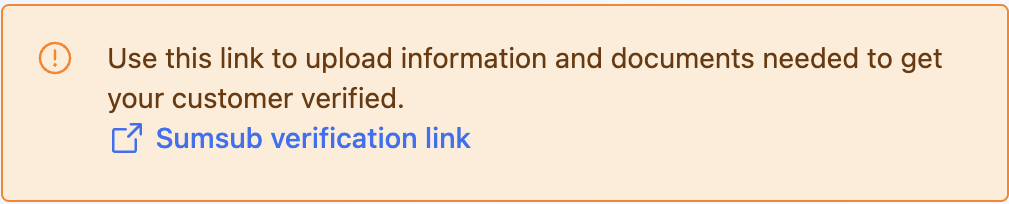

## Complete Onboarding

:::caution deprecated

The endpoint is no longer used in the onboarding flow. Now, onboarding procedures are completed automatically once you provide all the required documents and meet the Customer compliance requirements.

:::

Sends the confirmation of the onboarding completion.

* In the sandbox environment, Customer verification is automatically approved.

* In production, if the EPC meets all compliance requirements, the status will update to `VERIFIED`. If there are outstanding requirements or issues, the `INFO_REQUIRED` status is assigned, prompting manual review or further actions. If the verification is unsuccessful, the `REJECTED` status is assigned.

**Note**: Run this endpoint 10 seconds after uploading the documents. This time is needed for the system to acknowledge the documents and update the status.

---

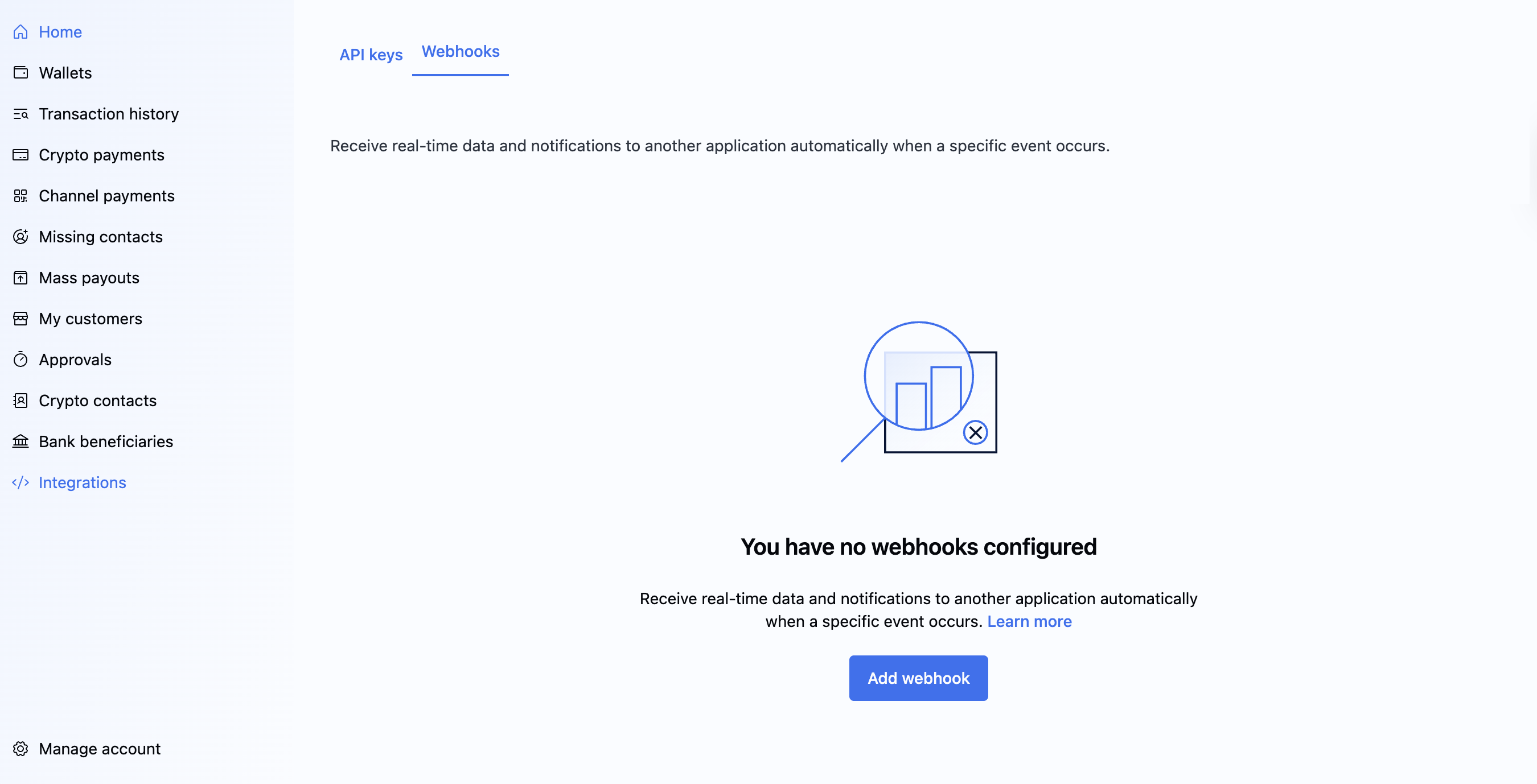

## Create or Update Account Webhook URL

:::caution deprecated

This endpoint has been deprecated and may be replaced or removed in future versions of the API.

:::

Creates or updates the the main account webhook URL that all webhooks are sent to.

---

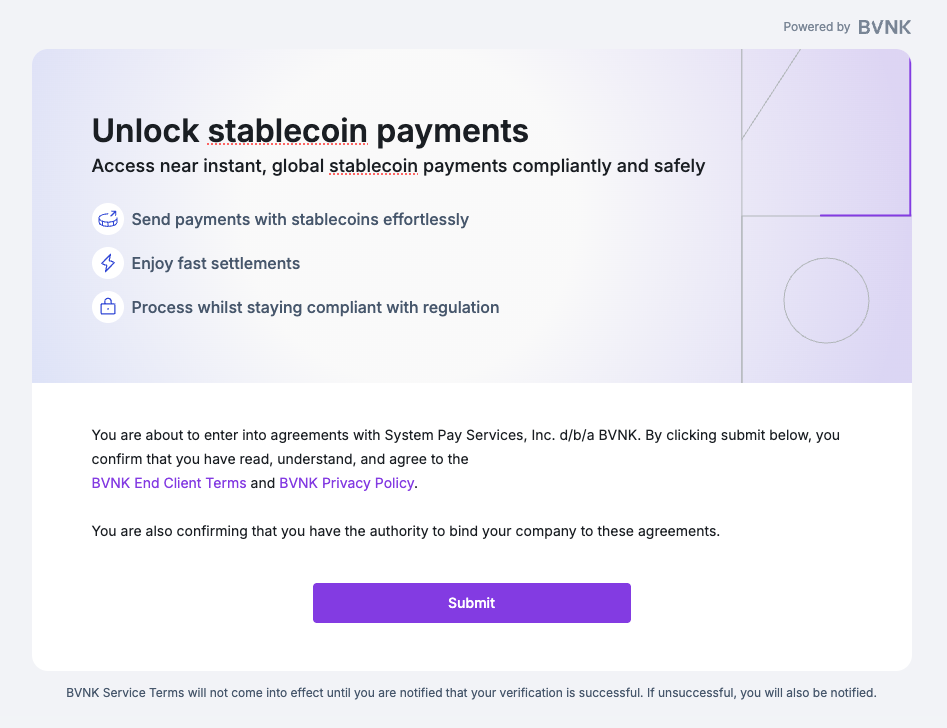

## Create Agreement Signing Session

Create Agreement Signing Session

---

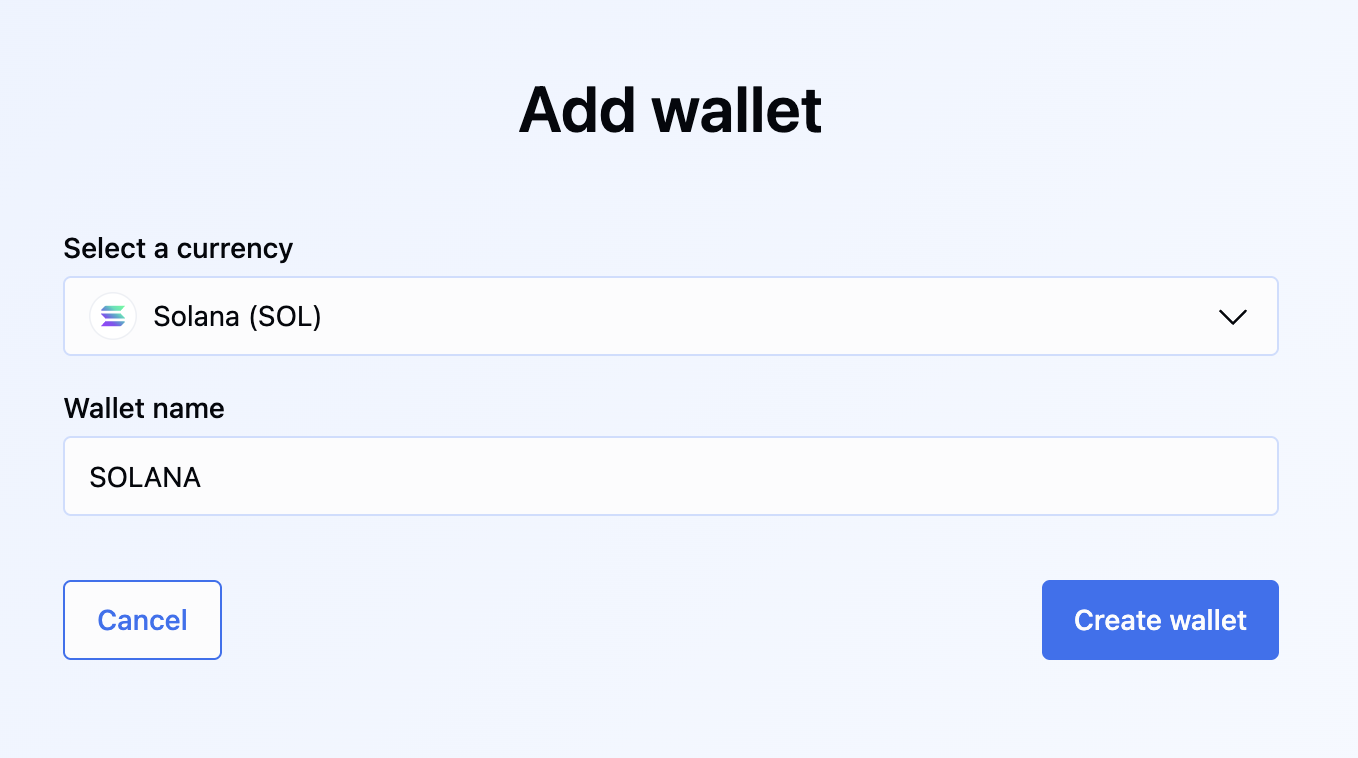

## Create Wallet

Creates a fiat or crypto wallet for a specific Embedded Partner Customer, generating a unique virtual account tied to the wallet.

---

For more information, how to apply it in the Embedded Wallets flow, refer to the [Create a customer wallet](https://docs.bvnk.com/docs/step-2-creating-a-customer-wallet-and-virtual-account#/create-a-customer-wallet) guide.

---

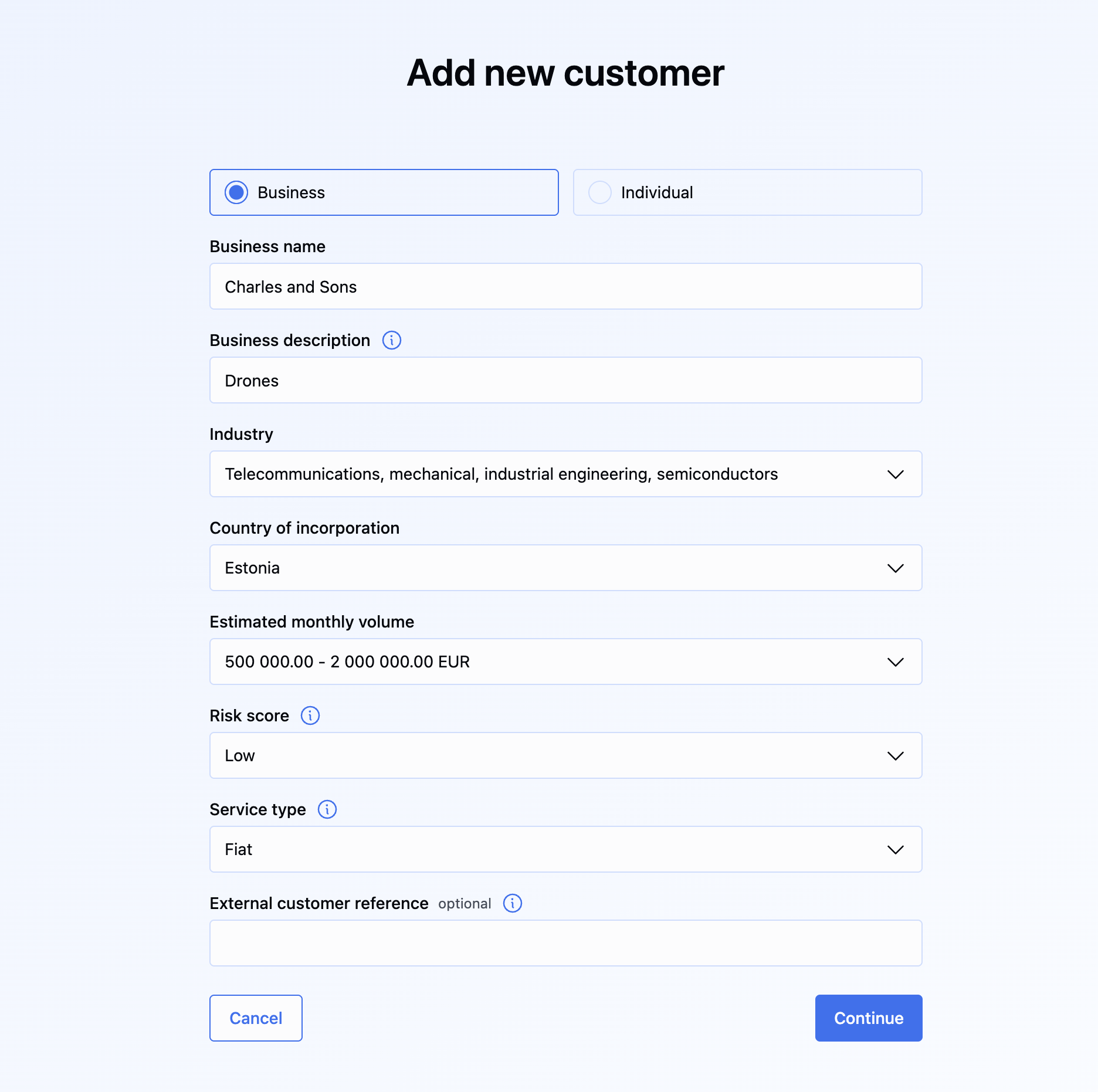

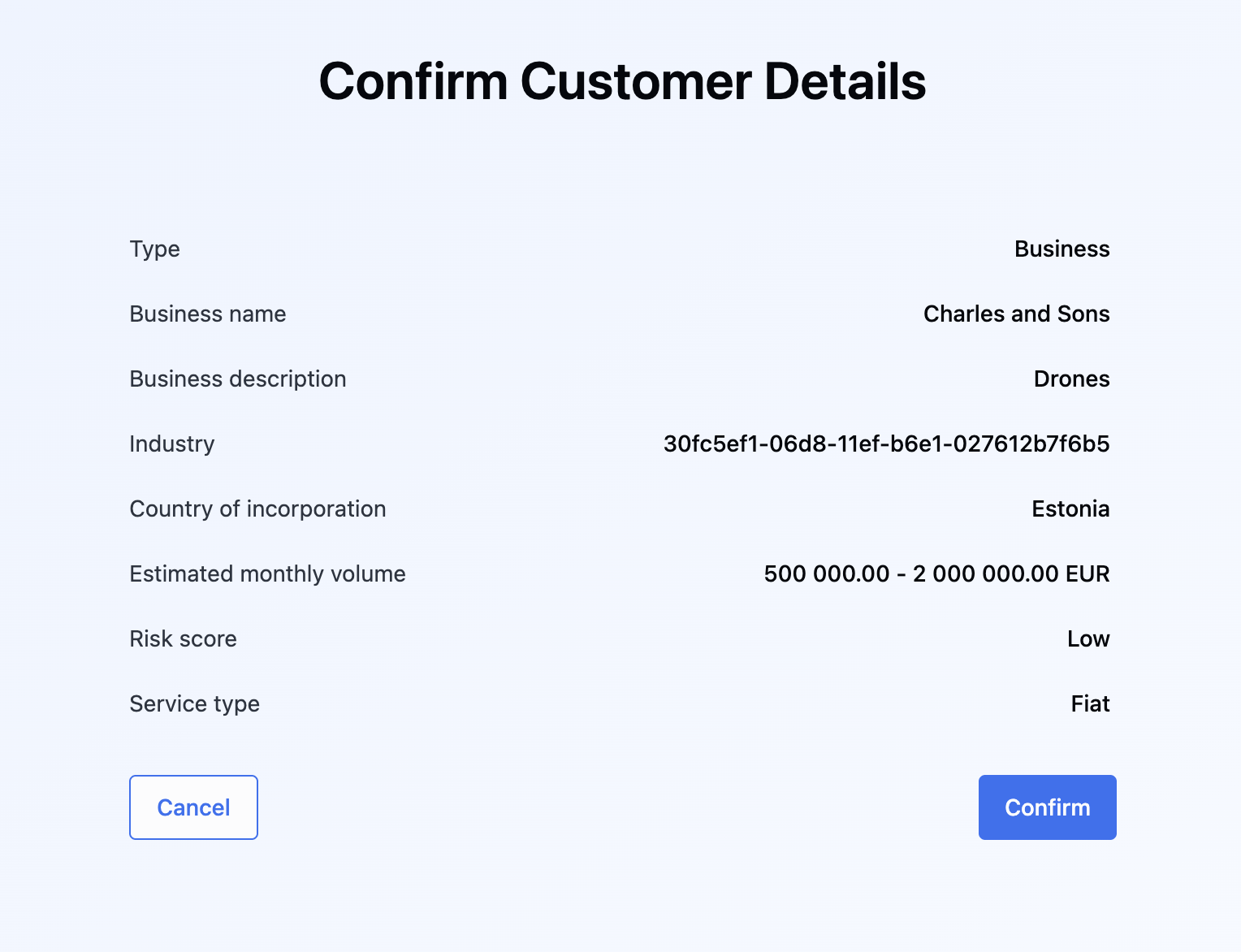

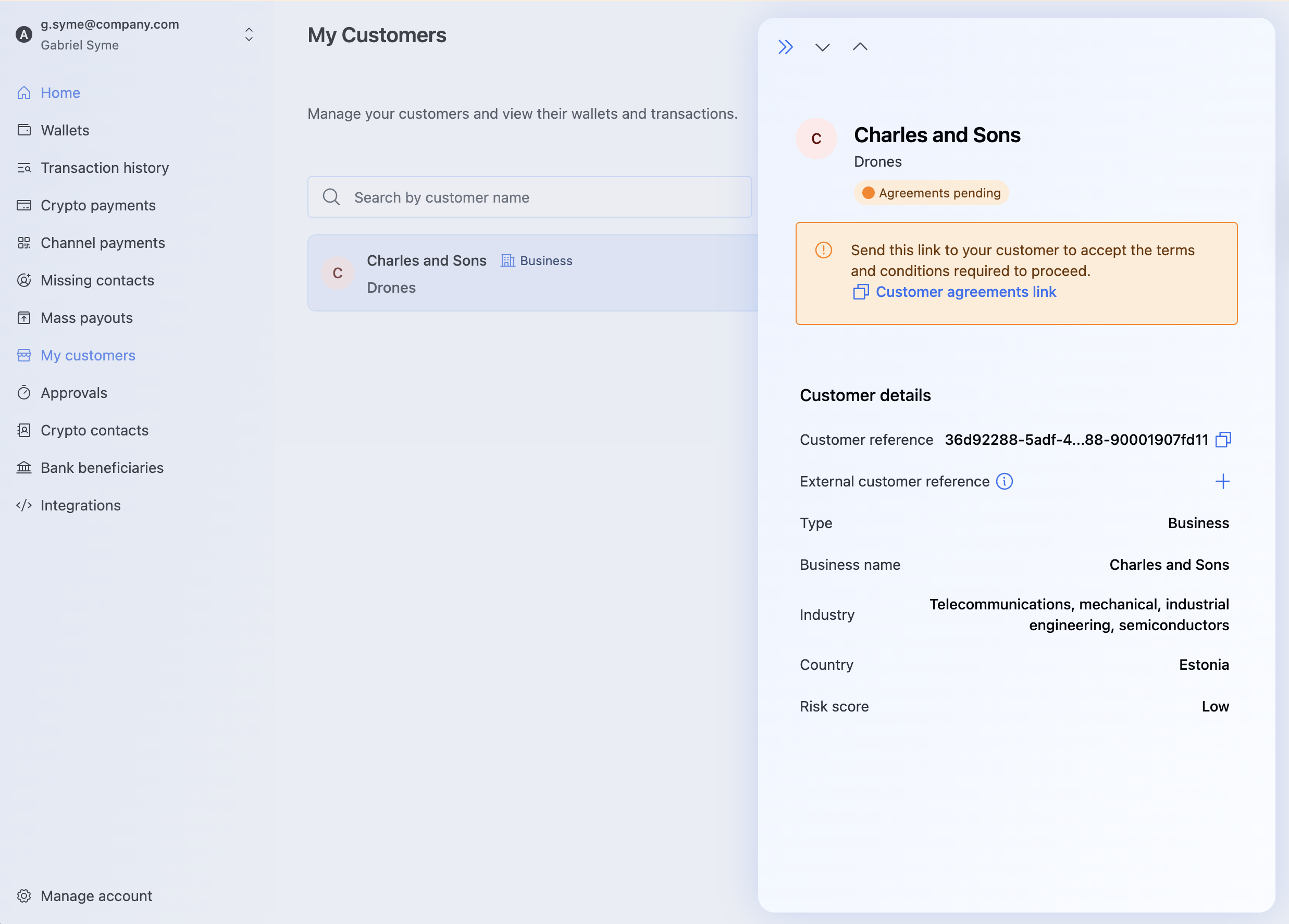

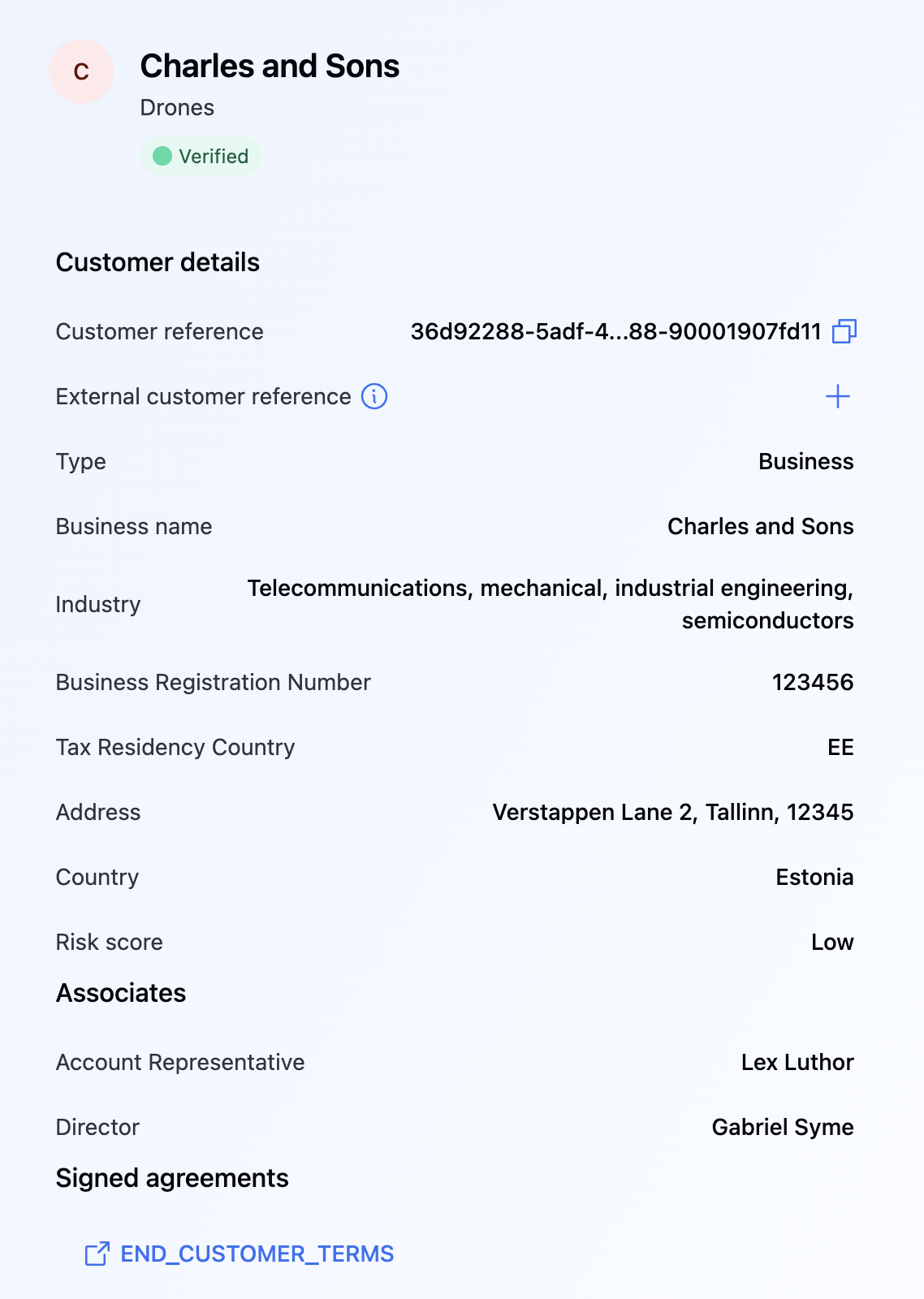

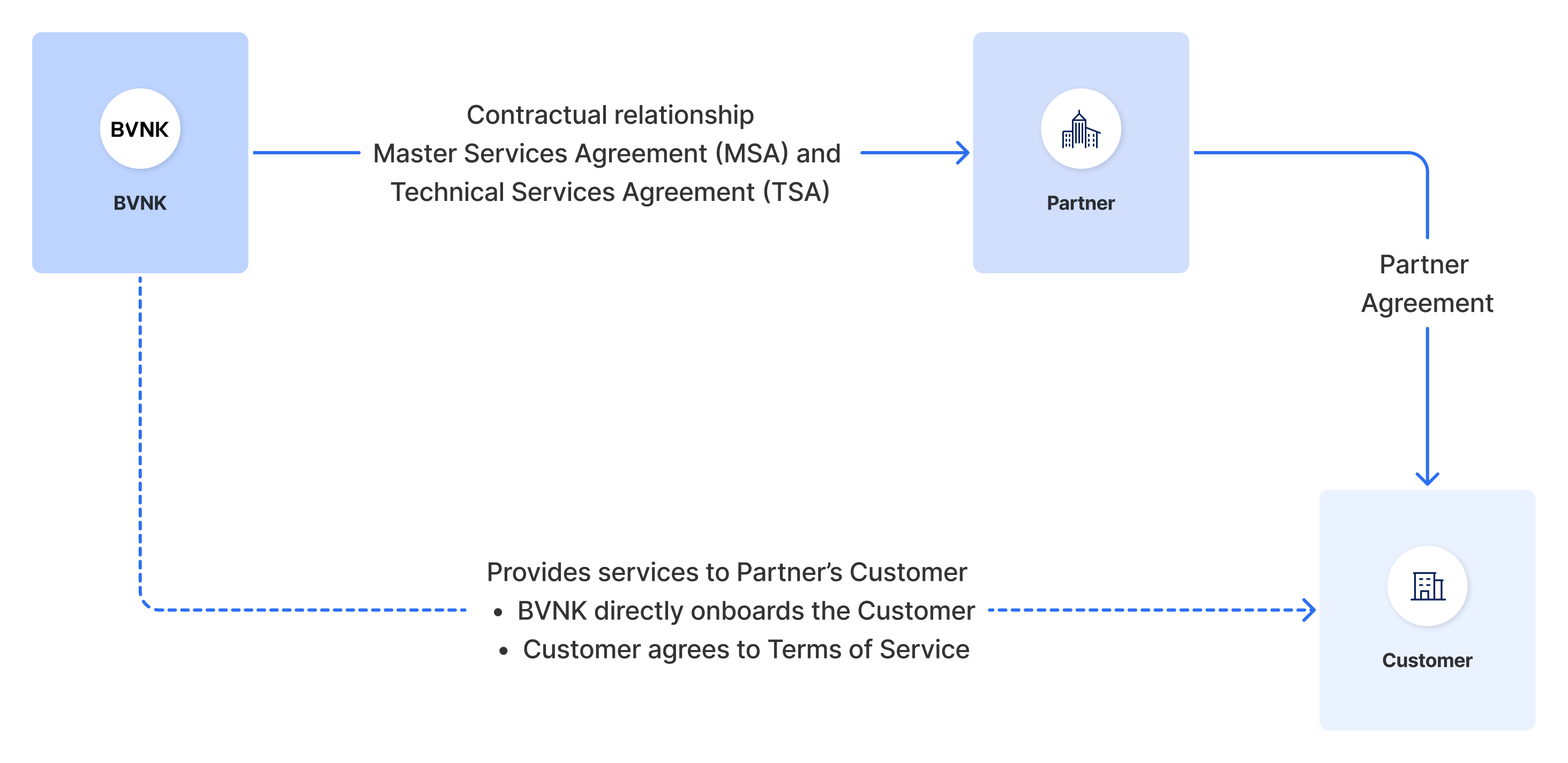

## Create Customer

Creates an Embedded Partner Customer account. The customer can be 'Individual' or 'Company'.

---

## Onboard Embedded Merchant

:::caution deprecated

This endpoint has been deprecated and may be replaced or removed in future versions of the API.

:::

Creates the Embedded Partner Merchant account.

---

## Create Report Schedule

Creates a new scheduled report that will be automatically generated and delivered according to the specified frequency and delivery preferences. Each user can create only one schedule per account.

---

## Remove a Document

Deletes a specified document from a Customer's profile.

---

## Delete Report Schedule

Deletes an existing report schedule. Only the user who created the schedule can delete it. Once deleted, no further reports will be generated according to this schedule.

---

## Estimate Refund Fee

Returns the estimated processing fee and the maximum remaining refundable balance for the pay-in. The fee will be deducted from your wallet when issuing a refund. The fee amount may vary depending on the merchant contract with BVNK.

---

## Fetch Account Webhook URL

:::caution deprecated

This endpoint has been deprecated and may be replaced or removed in future versions of the API.

:::

Fetches the the main account webhook URL that all webhooks are sent to.

---

## Retrieve Agreement Session Status

Returns the current status of an agreement session using its reference ID.

---

## Fetch Agreements

Fetch all required agreement documents needed to onboard an Embedded Partner Merchant.

---

## Get Customer Documents

Retrieves the details of the specific document added for the Customer. If no parameters are specified, retrieves the array of available documents.

---

## Get Customer Fee Wallets

Retrieves the list of available wallets that can receive customer fees.

For more information, refer to [Customer fees](https://docs.bvnk.com/docs/charge-customer-fees#/).

---

## List Required Information

Retrieves detailed information about what documents and data are required for customer onboarding when their status is `INFO_REQUIRED`. This endpoint provides specific requirements for documents, questionnaires, and additional data needed to complete the onboarding process.

---

## Get Customer

Get Customer

---

## Get Document Download URL

Retrieves a temporary URL for document download.

---

## List Industries

Retrieves a definitive list of industries and sub-industries, which can be included in the payload when creating a customer.

---

## List Monthly Expected Volumes

Retrieves a definitive list of Expected Monthly Volume values, which can be included in the payload when creating a customer.

---

## Get Questionnaire Definition

Fetches quiestionnaire schemas with questions, answer types, option lists. You can render the questionnaire in your UI.

Questionnaires include the following sections:**Nature of Business**: mandatory details related to company operations)**Document Requirements**: key compliance documents

---

## Search Questionnaire Submissions

Returns previously submitted questionnaire answer sets matching the supplied filters

---

## Get Supported Timezones

Retrieves a list of all supported timezones that can be used when creating or updating report schedules. Each timezone includes both the IANA timezone identifier and a human-readable label with UTC offset.

---

## List all Customer Wallets

Retrieves a list of wallets associated with Embedded Partner Customer.

Request without parameters returns all existing wallets.

Specify `customerReference` in query to retrieve wallet details of the specific EPC.

`. Default sort order is asc.","required":false,"schema":{"type":"string","example":"currencyCode,desc"}},{"name":"offset","in":"query","description":"Starting point for pagination, used instead of `page. Useful for cursor-based pagination.","schema":{"type":"integer","minimum":0,"default":0}}]}

>

---

## Get Wallet

Retrieves a specific wallet by its ID

---

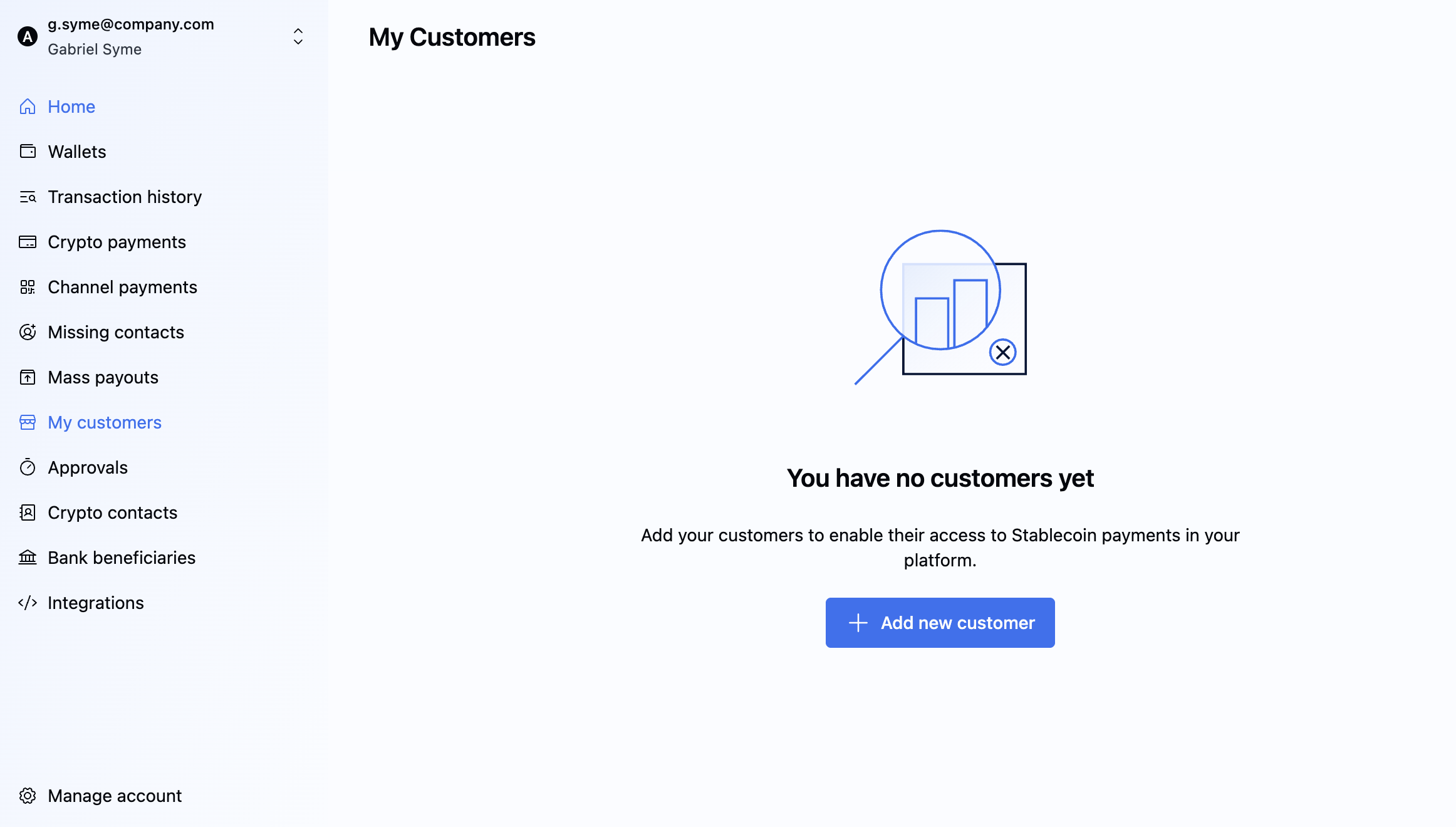

## List Customers

Retrieves the full list of Customers.

---

## Fetch Country Codes

Fetch list of all countries and associated ISO codes.

---

## List Crypto Currencies

Retrieves a list of all cryptocurrencies available on the BVNK platform. This list represents cryptocurrencies that end users can select whilst making a payment.

For sandbox, only Ethereum (ETH) is fully functional.

---

## List Wallet Currencies

These are the currencies that can be used to create a new wallet.

---

## List Fiat Currencies

Retrieves a list of all display fiat currencies available on BVNK's Crypto Payments API.

This list refers to currencies merchants can display on a payment page to an end user. It does not represent the list of currencies that can be held on the platform in wallets.

---

## List Exchange Rates

Lists available exchange rates for a given currency.

---

## List Report Schedules

Retrieves a paginated list of report schedules for the authenticated user's account. Returns all schedules created by the user with their current configuration and delivery preferences.

---

## Create Merchant ID

Generate a Merchant ID for your account to process pay-ins and pay-outs through our API.

A Merchant ID is essential as it designates the account wallet where incoming pay-ins will be settled. For instance, if a Merchant ID is associated with a EUR wallet ID, any incoming USDT payment will be automatically converted to EUR and deposited in the designated EUR wallet.

Vice versa, any outgoing USDT payment will be automatically converted and withdrawn from the designated EUR wallet.

For further information, please visit https://docs.bvnk.com/docs/creating-your-first-merchant to learn more about creating your first Merchant ID.

---

## List Merchant IDs

Retrieves merchant IDs setup on your account.

---

## Accept an Estimated Payout

Accepts the current estimate and converts it into a pending crypto payment.

---

## Get details of an estimate payout by ID

Retrieves the current estimate state by ID.

---

## Update an Existing Estimate Payout

Refreshes the quote using the latest exchange rates and fees. Call periodically (e.g., every 30 seconds) with either `walletRequiredAmount` or `paidRequiredAmount` to recalculate the other.

---

## Create an Estimate Payout

Retrieves latest exchange rates, fees and network costs for a crypto payout without creating an actual payout. Provide either `walletRequiredAmount` (amount to send) or `paidRequiredAmount` (amount the recipient should receive). See the [Estimate Crypto Payouts](https://docs.bvnk.com/docs/estimate-crypto-payouts#/) guide for details.

---

## Accept Payment

Accepts a pending payment with currency or payout information.

---

## Confirm Payment

Confirms a two-step payout.

---

## Create Payment

Creates an incoming (type IN) or outcoming (type OUT) crypto payment.

Alternatively, it creates a crypto payment that is either sent via a Customer's wallet or deposited into it. For more information, see the [Make Crypto Payments](https://docs.bvnk.com/docs/create-a-crypto-payout#/) guide.

There are two flows depending on specifying `payOutDetails`:

- If you add `PayOutDetails` with all its child parameters, the payment is successfully created and the funds are sent to the specified wallet, with no further actions needed.

- If not included in the request, in the response you receive `redirectUrl`. This is a link to a page, where to you can redirect your Customer so they can finalize the payment.

---

## List Payments

Retrieves a list of payments on a specific Wallet ID.

---

## Validate Address

Validates that a crypto address is correct.

Use this endpoint to validate that an address exists, is correctly formatted, and includes all the required data. This endpoint can help prevent your end users losing funds when submitting a payout.

---

## Get Payment

Retrieves details of a specific payment using the UUID of the payment.

---

## Create on-ramp payment rule

Creates a rule that links a crypto wallet to a fiat virtual account to automatically handle on-ramp (fiat → crypto) flow. The `trigger` field defines the flow to activate:

- `payment:payin:fiat` — on-ramp

For more information, see the [Automate Fiat-to-Crypto Transfers](https://docs.bvnk.com/docs/automate-fiat-to-crypto-transfers#/) guide.

---

## Update Payment Rule

Partially updates a previously created payment rule. Only properties included in the request are updated; omitted fields remain unchanged. Setting a nullable property to null clears it.

---

## Update Payment

Updates a pending payment with currency or payout information.

---

## Confirm Beneficiary's Name

Confirms a payout when the beneficiary name check returns a mismatch warning. If not confirmed within five minutes, the action expires. In this case, make a new payout.

---

## Initiate Payout (ver. 2)

Creates a payout to business or individual customers.

In case of payment in Euro, the transaction is subject to **Verification of Payee** (VoP): if the beneficiary's name in the request doesn't match the name in the beneficiary's bank account, the status 202 Verification Failed is returned. To proceed with the payment, you must [Confirm Beneficiary's name](https://docs.bvnk.com/reference/payoutconfirmbeneficiaryv2#/). For the details, refer to the [Initiate Payouts (ver. 2)](https://docs.bvnk.com/docs/initiate-payment-2#/) guide.

---

## Retrieve Payout (ver. 2).

Retrieves a specific payout. You can also use this endpoint to check the status of the crypto or fiat payout.

---

## Get Payout

:::caution deprecated

This endpoint is deprecated. Please use the `GET /payment/v2/payouts/:transactionId` endpoint instead.

:::

Retrieves a specific payout.

You can also use this endpoint to check the status of the crypto or fiat payout.

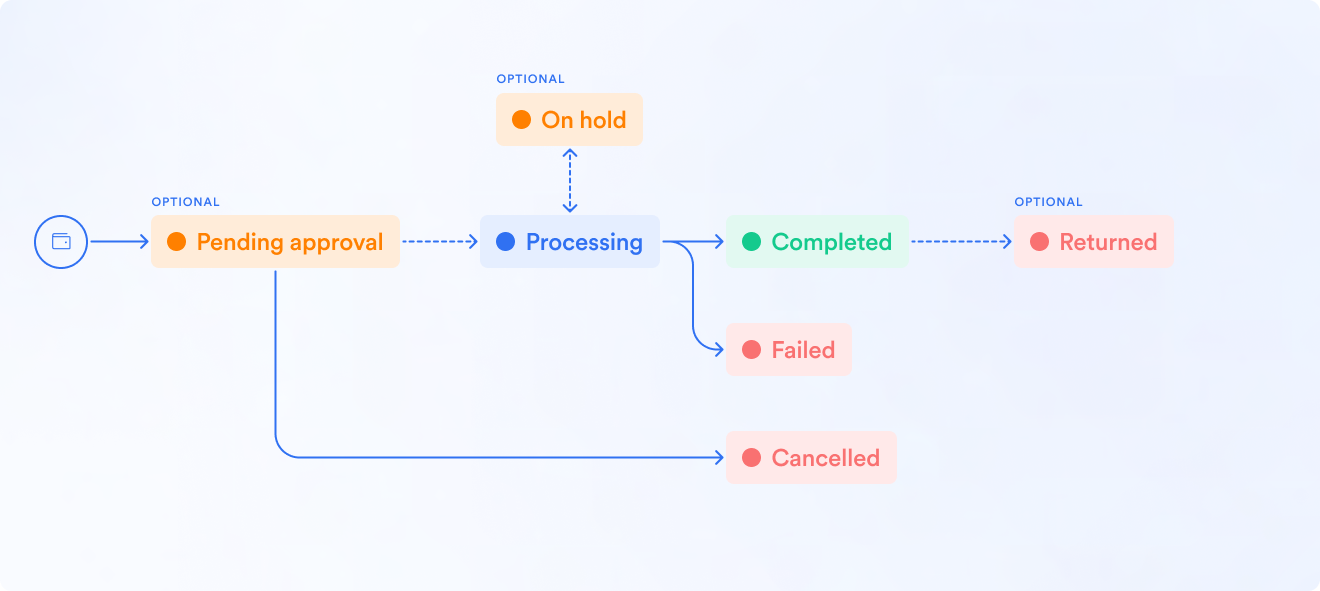

**Note**: The PENDING_APPROVAL status is only relevant for **fiat payouts**.

---

## Accept Quote

Executes a quote.

---

## Create Quote

Creates a quote to convert currency between wallets.

For wallet-to-wallet payment quotes, the payment processing is synchronous. You can expect the following statuses in the response:

| When | `quoteStatus` | `paymentStatus` |

|------|-------------|---------------|

| **Successful payment**|| |

| Getting an estimate | `ESTIMATE` | `PENDING` |

| Creating a quote | `PENDING` | `PENDING` |

| Accepting the quote | `PAYMENT_OUT_PROCESSED` | `SUCCESS` |

|**Failed payment**|| |

| Pay-in fails | `PAYMENT_IN_FAILED` | `FAILED` |

| Conversion fails | `CONVERSION_FAILED` | `FAILED` |

| Pay-out fails | `PAYMENT_OUT_FAILED` | `FAILED` |

If you don't receive `"paymentStatus": "SUCCESS"` in the response, you can call `/api/v1/quote/{uuid}` to check the conversion progress.

---

## List Quotes

Retrieves all quotes on a specific Merchant ID.

---

## Get Quote

Retrieves a specific quote.

---

## Get Exchange Rate

Provides a mid market exchange rate between two assets.

---

## Refund Pay-in

Initiates seamless one-click refund processing for any previous pay-in. Once accepted, a refund transaction appears in your portal and can be acquired via API.

Upon activation, the system automatically generates a new transaction according to our standard workflow. You can request multiple refunds for the same transaction, as long as the total refunded amount doesn't exceed what was originally paid in.

---

## Set Wallet for Customer Fees

Sets up the customer fee wallet for a specific currency. The customer fee wallet is where the collected customer fees will be credited when processing transactions. For more information, refer to [Customer fees](https://docs.bvnk.com/docs/charge-customer-fees#/).

---

## Simulate Pay-in (ver. 2)

Simulates pay-ins with different currencies and payment methods in the sandbox environment.

This version allows specifying originator entity details (individual or company) for more comprehensive testing scenarios.

---

## Simulate Pay-in

:::caution deprecated

This endpoint has been deprecated and may be replaced or removed in future versions of the API.

:::

Simulates pay-ins with different currencies and payment methods in the sandbox environment.

---

## Submit Questionnaire

Submit questionnaire answers provided by EPCs. BVNK validates completeness asynchronously and transitions the customer to the next onboarding state when all required answers are present. In case some answers are missing, BVNK specifies them and waits for all the answers to be submitted

---

## Create Internal Transfer (ver. 2)

Creates an internal stablecoin and fiat transfer between EPC and EP wallets.

Payment combinations:

- Crypto to crypto

- Fiat to fiat

---

## Create Internal Transfer

:::caution deprecated

This endpoint has been deprecated and may be replaced or removed in future versions of the API.

:::

Create an internal Fiat transfer to an existing beneficiary wallet.

---

## Get Transfer (ver. 2)

Retrieves a specific transfer details.

---

## Get Transfer

:::caution deprecated

This endpoint has been deprecated and may be replaced or removed in future versions of the API.

:::

Retrieves a specific transfer details.

---

## List Transfer Beneficiaries

Retrieves a list of beneficiaries eligible for transfers for a specified wallet.

---

## Update Agreement Session Status

Updates the signing status of an agreement session. Typically used after user submission to mark the session as SIGNED or DECLINED.

---

## Update Existing Report Schedule

Updates an existing scheduled report with new frequency and delivery preferences. Only the user who created the schedule can update it.

---

## Upload Documents to Customer

Attach one or more documents to a customer's profile. This can be either a company customer (with optional linkage to a specific associate) or an individual customer. Files must be base64-encoded before submission.

- For company-level documents, omit `customerPersonReference`.

- For associate-level documents, provide the `customerPersonReference`.

- The customer must be in `INFO_REQUIRED` status.

---

## Verify Beneficiary's Name

Verifies the beneficiary's name. You can call this endpoint before creating a payout via [`POST /payment/v2/payouts`](https://docs.bvnk.com/reference/payoutcreatev2#/) to verify the beneficiary's name and receive a verification ID that can be used in subsequent payout requests.

When using this endpoint, make sure you specify the same beneficiary's names as you will use in the payload of the [Initiate Payout](https://docs.bvnk.com/reference/payoutcreatev2#/) request.

---

## List Wallet Balances

Retrieves the balances of your wallets on platform.

---

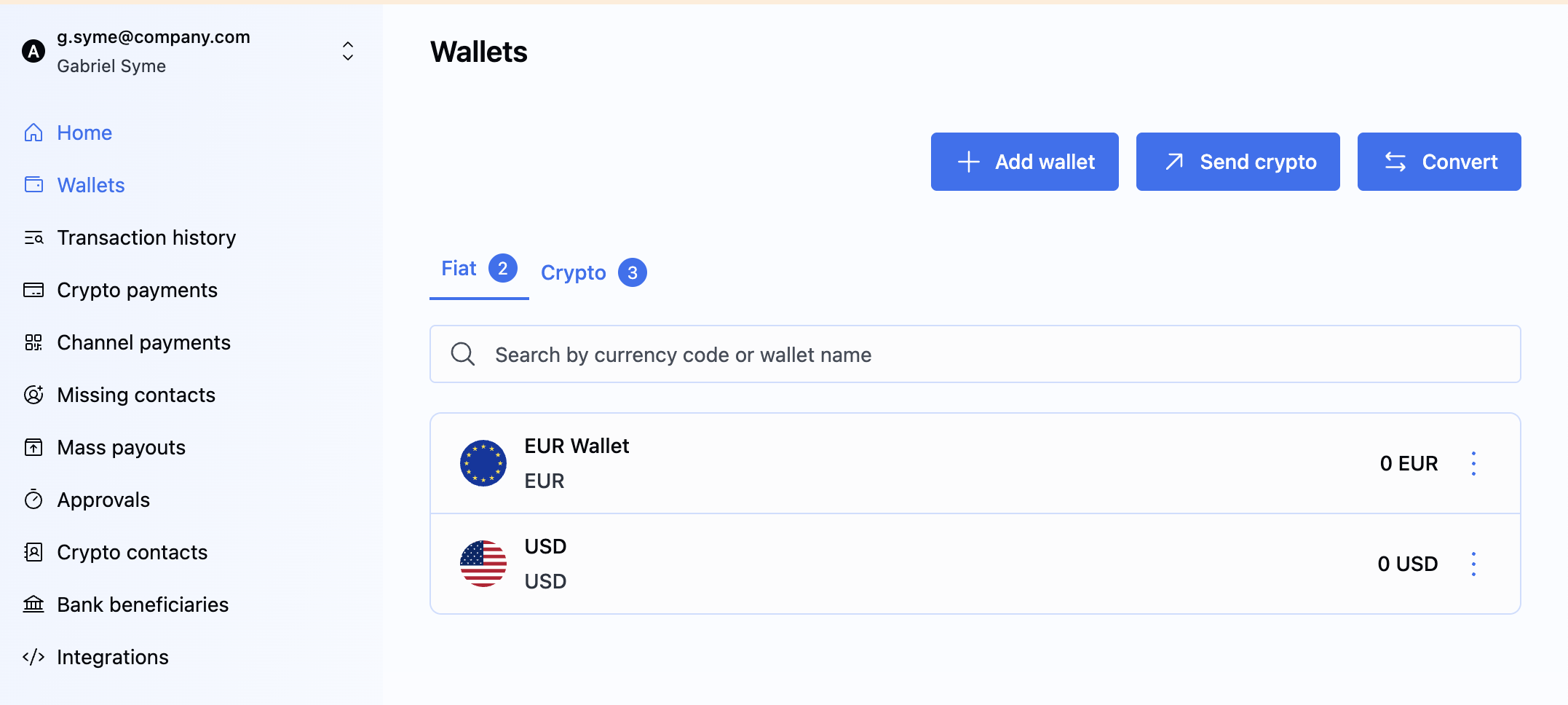

## Create Wallet(Bvnk-main-api)

Creates a wallet on the BVNK platform.

---

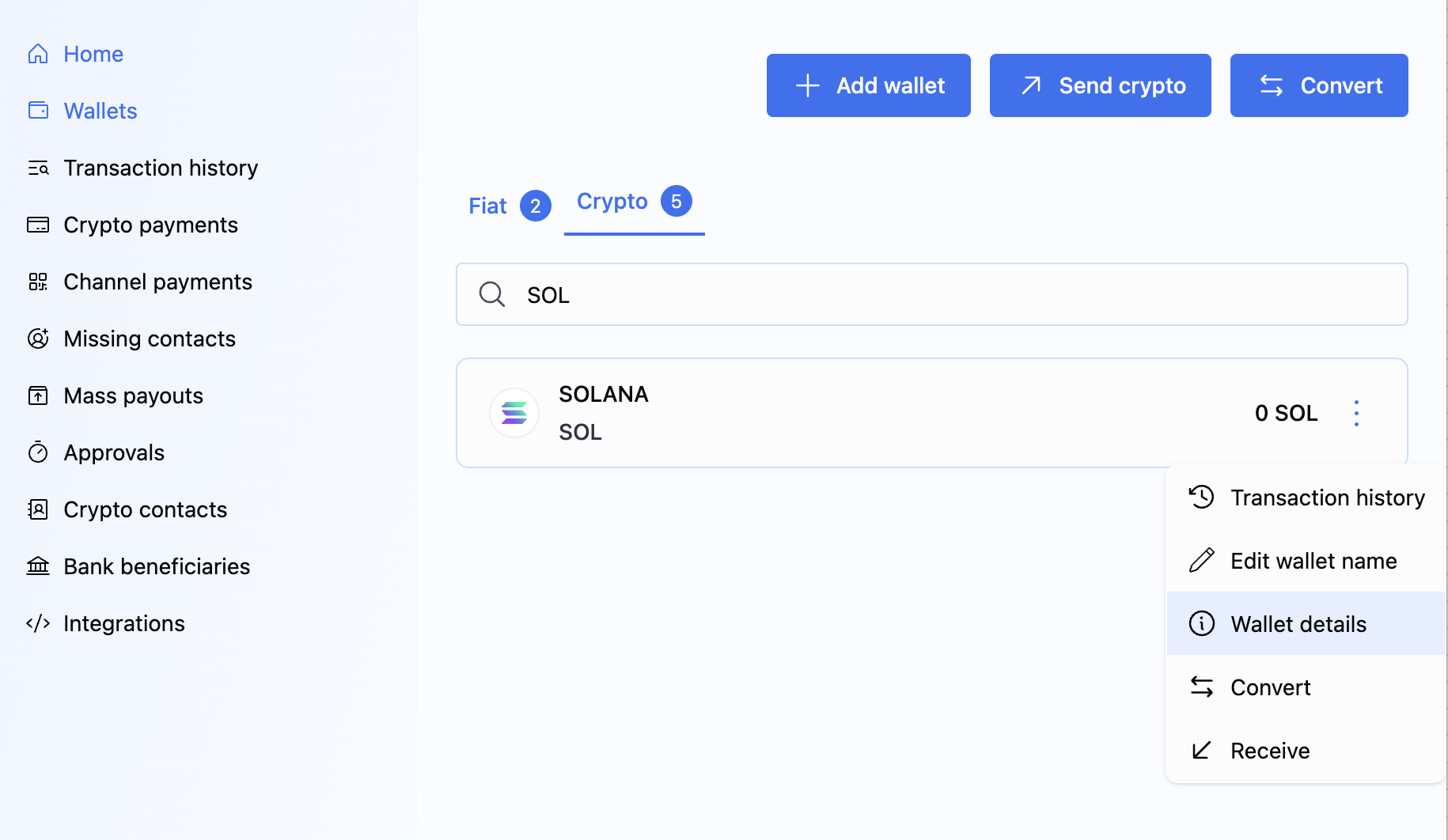

## List Transactions

Retrieves a paginated list of transactions for a specific wallet. Supports filtering by `walletId` and optional date range.

The date range can be applied to the `createdAt` or `updatedAt` timestamp, determined by the `filterMode`. If omitted, the `filterMode` defaults to `CREATED_AT`.

Refer to the [Fiat payments guide](https://docs.bvnk.com/docs/listing-transactions).

---

## List Wallets

Retrieves a list of wallets on your account. Displays the first 10 wallets without max set to higher

---

## List Wallet Profiles

Returns available wallet profiles based on optional filters for currency codes and payment methods.

---

For more information, how to apply it in the Embedded Wallets flow, refer to the [Assign a wallet profile](https://docs.bvnk.com/docs/step-2-creating-a-customer-wallet-and-virtual-account#/assign-a-wallet-profile) guide.

---

## Get Wallet(Bvnk-main-api)

Retrieves detailed information about a specific wallet.

---

## Transactions Report V2

:::caution deprecated

This endpoint has been deprecated and may be replaced or removed in future versions of the API.

:::

Report all transactions from wallet in specified format. Report will be generated and sent to main account email in the specified format.

---

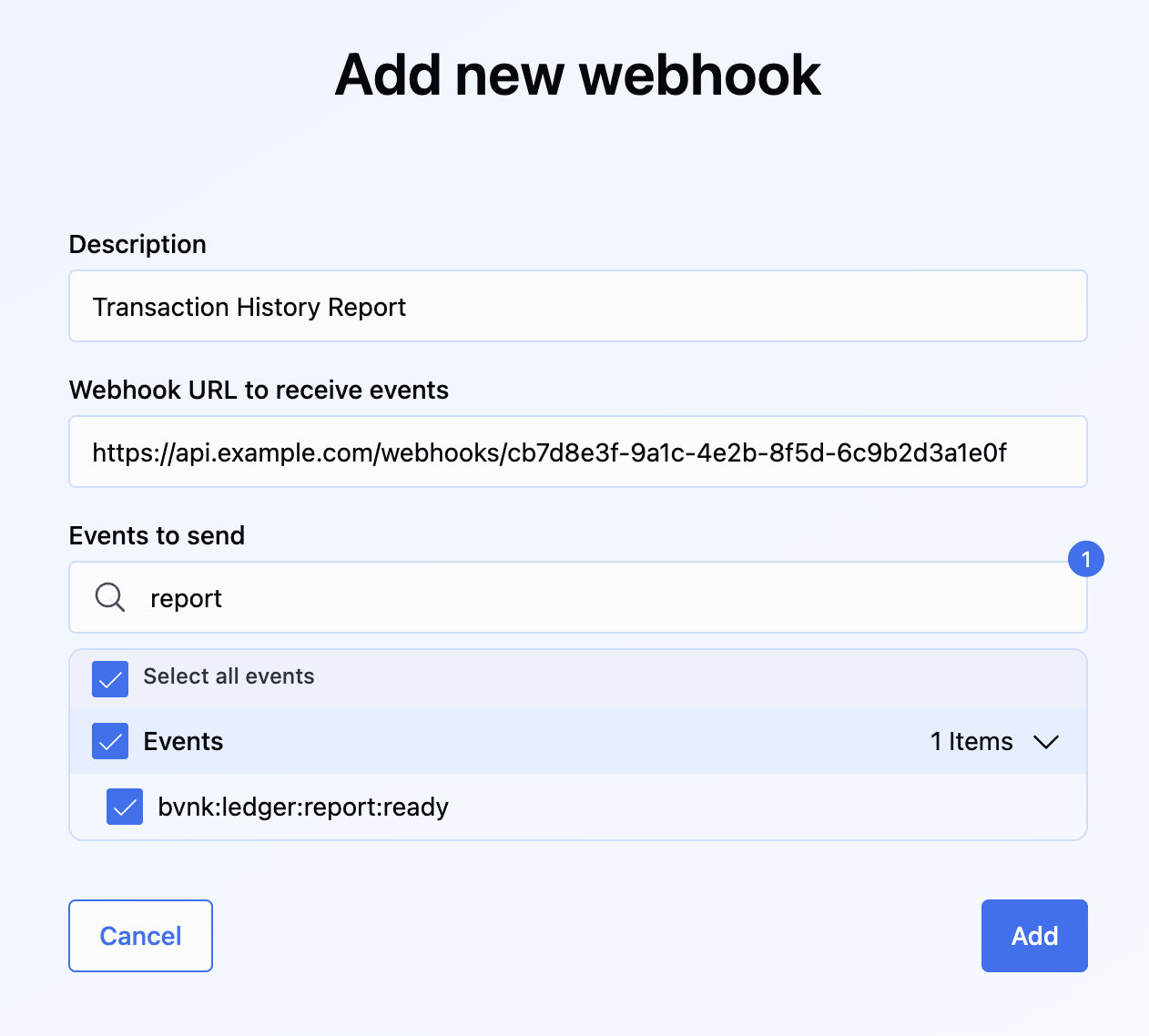

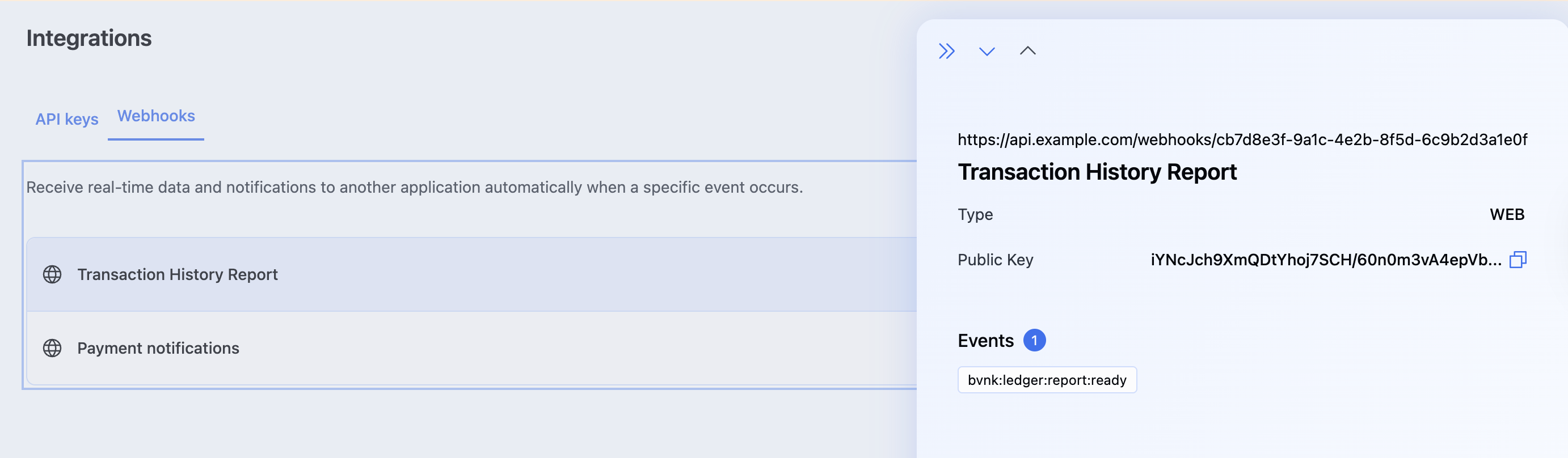

## Transactions Report

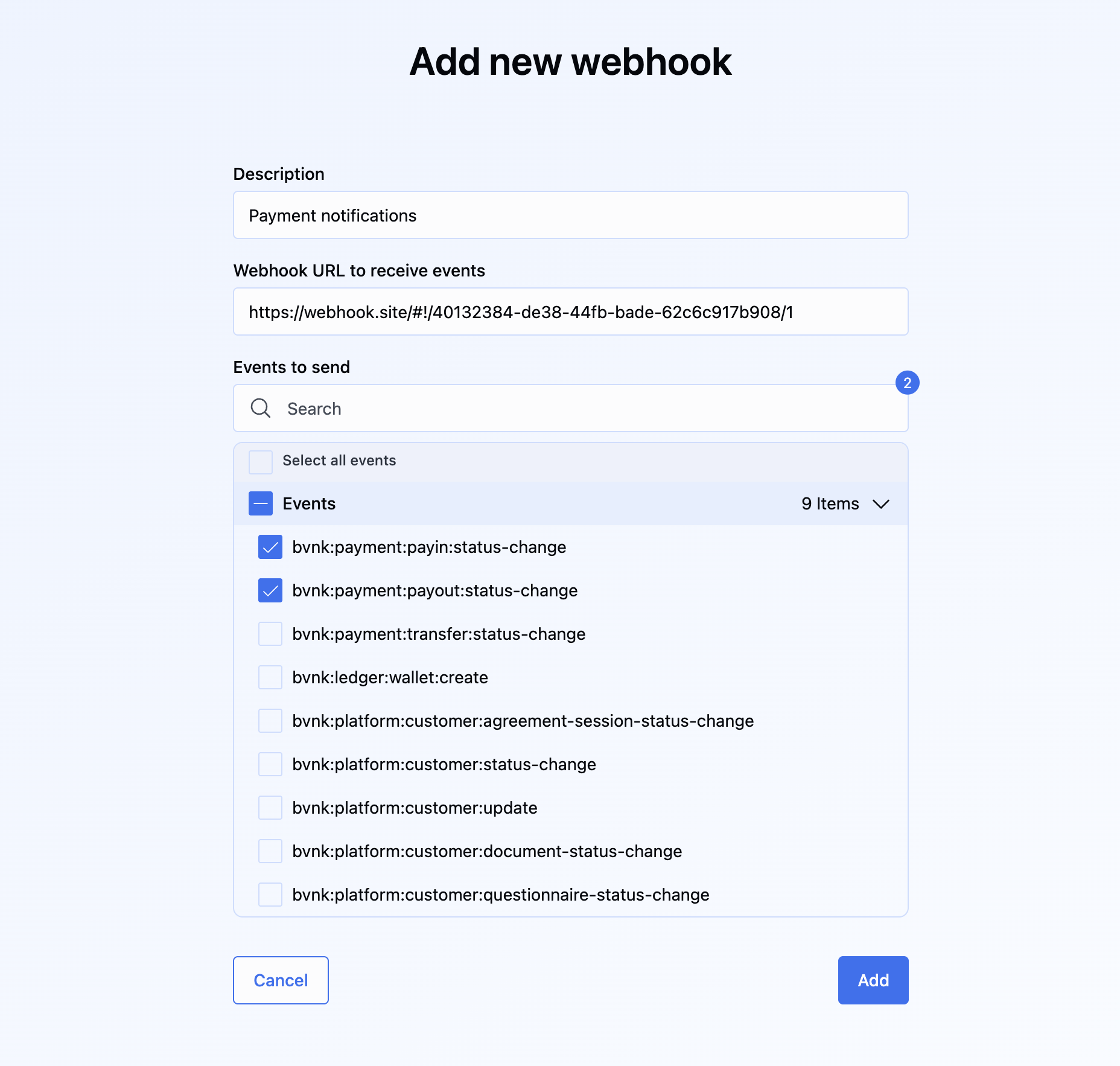

Creates a report of all transactions from a wallet in the specified format and sends it via the preferred delivery method: WEBHOOK or EMAIL.